Although rarely seen Morning Star & Evening Star Candlesticks are often considered important reversal signals on trading charts.

Sometimes price opens up what traders call Gaps at tops and bottoms of momentum swings. There is a gap between the closing price of one period or candle and the opening price of the next candle. When price gaps down at bottoms and then pauses or when price gaps up at tops and then pauses you may see a reversal.

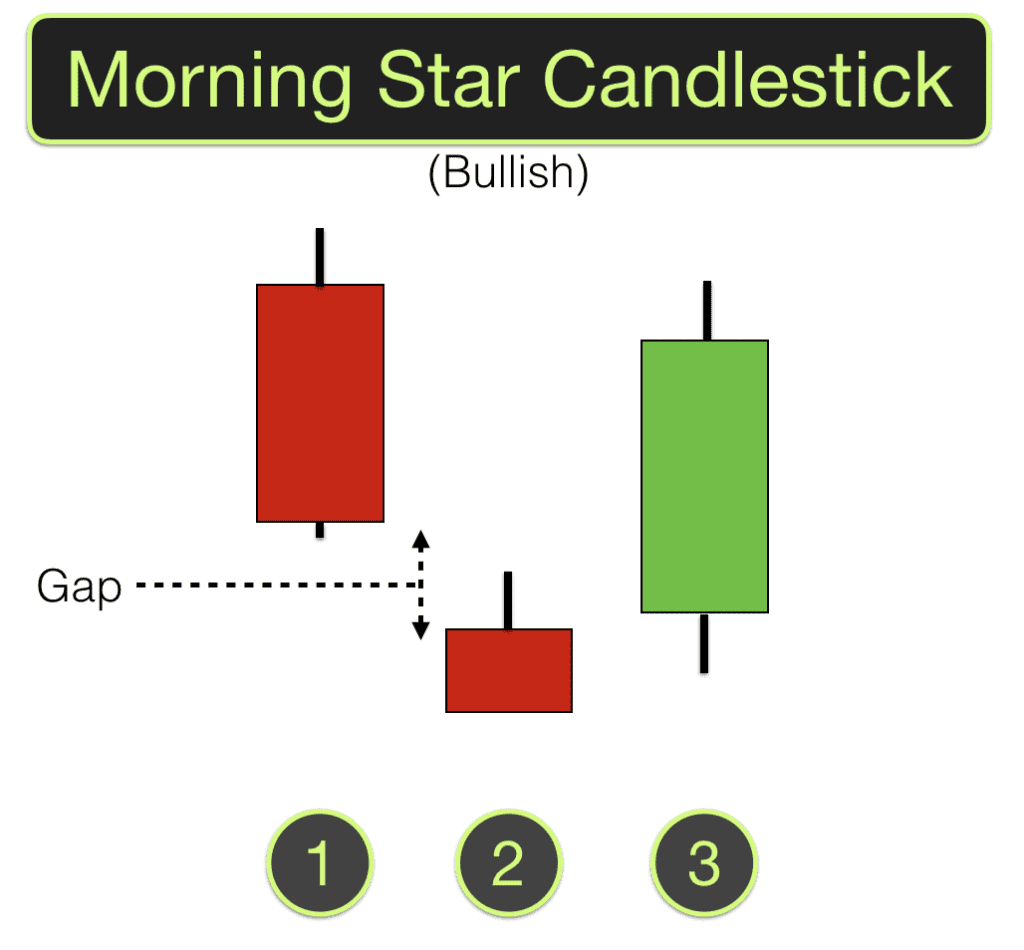

Morning Star Candlesticks

Morning Star candlesticks are seen at bottoms. A Morning Star is the last candle of darkness (a down move) and indicates that dawn may be just around the corner (a rise in prices).

In fact the Morning Star is part of a pattern of three candles. After a bearish candle, price gaps down (it may be a large gap or only small), and then a small candle is produced. This is the pause, the Morning Star. This Morning Star candle can be green or red. The third candle in the series may open after a gap up, but it doesn’t have to in order to validate the pattern, it may open at the close price of the Morning Star. The third candle must be a bullish candle with little or no tail. It reverses upwards retracing the price movement taken by the first candle in the pattern.

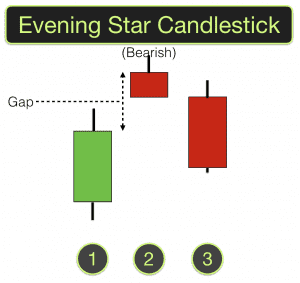

Evening Star Candlesticks

An Evening Star candle pattern is the same in form as the Morning Star pattern except that they occur at the top of price swings. It occurs at the end of daylight (a move up) and before dark (falling prices).

Candlesticks can be great trading signals if used within a structured trading plan. Design and trade your own profitable trading system in our day trading training course.