Day Trading – Discover your missing pieces

Profitable traders have a recipe for success and in this series I am going to talk you through all the ingredients (components) that you need to incorporate into your learning, your trading strategies, and your life outside of trading in order to give yourself the best possible chance of becoming a profitable trader and trading for a living.

These are the 10 essential components that you need in order to become a successful trader.

I’m going to go into some depth in each area and give you practical tips, examples and actionable ideas so that you can start improving your results today.

New to trading?

If you are new to trading, then this will give you a clear path to go down in order to learn to trade, a roadmap for you to follow and a compass for you to use so that you know where you are as you develop your knowledge and skills.

Trading for a while and are yet to be profitable?

If you have been trading for a while and are yet to be profitable then I will be giving you some pointers as to what you need to add in and remove from your systems and strategies to turn your trading around.

Trading profitably and know that you can do better?

If you are trading profitably and know that you can do better, then you will find things in here that could be the missing pieces to your puzzle.

Let me set the scene for you a bit. When I talk about trading, I’m talking about short term buying and selling of stocks, contracts, commodities, things like that. As traders, we buy when we think a price will rise and sell when we think a price will fall. We go long to profit from rising prices and go short to profit from falling prices.

We look for reasons, logic as to why prices may rise or fall. Some traders may look at fundamental factors like future product demand or supply and factor in news related information, or use technical analysis (chart analysis), or a combination of both.

Since we are operating in the short term, traders almost all use some kind of technical analysis to judge changes to supply and demand, which will affect prices.

We do not buy and hold – this is called investing. We do not sell and hold. We set short term profit objectives and loss limits for their trades. We make decisions quickly based on the information that we are analysing and we either end up making money or losing money based on this decision. Either way we get to find out quickly!

I’m going to concentrate today on talking about trading using technical analysis as this is my field of expertise.

Let’s get straight into it:

What are the 10 things that we need to have in order to become a successful trader?

- Have a successful system and stick to it (like super-glue)

This first one may seem obvious at first but it is vital to understand exactly what I mean.

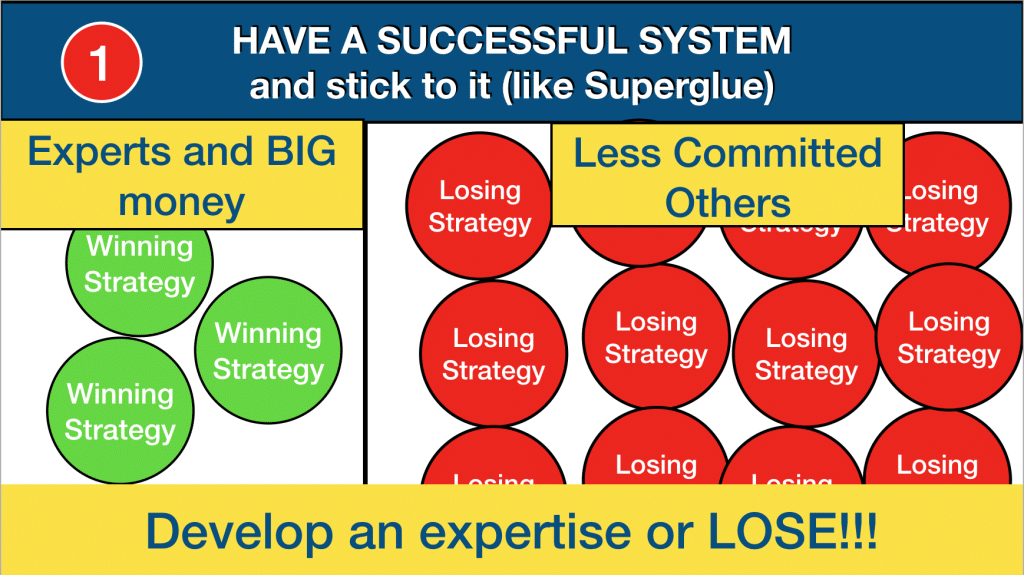

There are lots of different ways of making money in trading, lots of trading systems that are effective and many more ways of trading that will end up in losses, systems that are unworkable or loss-making over a period of time.

It simply is not possible to turn to the markets having read a few books or after watching a few videos and expect to make money. Without developing an expertise, having a system that is time tested for profitability and that you can operate effectively you will lose money. I can guarantee it!

In trading only a small portion of traders are profitable. The money tends to flow to these people. People and organisations throw millions into developing profitable systems, educating themselves and their traders. They commit everything to their cause. These are the people whom you are competing against. Success often comes at a price, in terms of money and in terms of time spent gaining an expertise. Trading will test you again and again. Your level of commitment and resolve to succeed will likely determine whether or not you make it in the end.

You need to inherit or develop a trading system or set of strategies that are PROVEN to be profitable.

A trading system is one that involves a strategy or number of strategies. It includes money management tactics, like position sizing and risk management, which we will discuss later and it also includes things like:

- Trade entry and exit criteria

- Chart settings

- Trading hours

- The markets that you will trade

- Trading Timeframe

- Targets and Protective Stops

- The Trading Indicators you will use and how you will use them

Profitable strategies and systems do exist. I have developed several of my own and adopted a few from other people (after tweaking them slightly). However I spent several years perfecting my strategies and making them effective for my needs. During this time I changed them time and time again, too many times.

Some days in the past I traded many different systems and strategies within those systems and by the end of the day I even lost track of what system I was supposed to be trading! This doesn’t work and if this is also true for you now then you need to stop trading until you have done some more learning, done some testing, and are 100% committed to a system that works.

Tip: You need to start with one system and one trading strategy within that system. Once you are profitable with that one strategy then you can add additional strategies into your system.

You only need a small edge to win in the markets and one strategy can produce that edge for you. If you want a good reference for this then read the story of the Turtle Traders. They made millions from just one simple strategy. The key to that success? The traders operating the strategy were given precise instructions and no room at all was given to deviate from that strategy

You need to know your system and strategy inside and out, back to front and be able to recite it word for word to me if I came to you and woke you up at 4am!

If you take a trade and it doesn’t fit within your system you bend the rules “just this once”, then this is a serious problem. Think of the message that you are giving yourself. “It is OK to break the rules of my system.” This is potentially the end for your system and for your trading career.

You need to impose a form of self-punishment, enforce upon yourself a break from trading.

If you are day trading and you deviate from your system or strategy in any way on any trade, then you must stop trading for the day. Adopting this tip alone could save you thousands. :)

If you are constantly changing your strategy and the rules within your system then how are you ever going to find out whether it works? You may already have a successful system but if you don’t operate it consistently then it is useless to you.

How do you know if you have a trading strategy that works?

If you have a trading strategy and you are not profitable then how do you know that your strategy works?

There are some important questions here that I think that you should be asking yourself.

Did you get the strategy from someone else? If so, then ask yourself, “How do I know that they are trading that strategy profitably? How do I know that it is actionable for me? How do I know that it fits my preferred trading style and my risk tolerance?”

If you developed the strategy yourself then how accurately did you backtest it? Ask yourself, “What level of past data did I use to test it? Do I know anyone else who is using a strategy that is similar to mine and making it work for them?”

With any successful trading strategy we must be able to look back over past data and be able to pull out recognisable examples of opportunities presented by the markets where our strategy would have triggered a trade.

Action: Look back over at least 100 examples and test the criteria of your strategy exactly to see whether, if you traded your system and strategy exactly on each occasion, you would have been profitable at the end of the series.

In order to look back over 100 similar examples of market behaviour we need to be able to easily pick them out on the chart. We need to have sufficient chart reading expertise to be able to do this.

When I talk about chart reading and assessing charts then I am not talking about pulling out one particular type of candlestick pattern and seeing if the market moved as expected. There is more to it than that.

Which brings us nicely on to our second point: Read more in part 2..