We are already on to component number eight to successful trading. Successful traders Part 8 – Keep accurate and detailed records of your trades.

This is the eighth habit of highly successful traders.

We are going to keep it simple today.

My message today (meant with the best possible intention), is: “Keep paper/digital records of every trade that you take”.

I say this to all of my trading clients. The traders who become successful listen to me and keep detailed records of their trades.

The others…well, let’s just say that there is a direct relationship between keeping detailed trading records and success in trading.

You need to know whether or not you have a verifiable edge over the market. The only way of knowing this is to make consistent trading decisions and to record the details of your trades.

This will help you when you look back in a couple of ways:

Firstly you can assess how closely you have traded compared to your plan.

Secondly you can break your trades down into types, according to market conditions and trade setups so that you can make decisions over optimising your system in order to gradually improve your results.

What trading system details should you be familiar with?

Good traders know their win percentage. For each type of trade that they take they can tell me what type of market conditions they work in and the differing percentage win rate depending on the various market conditions.

All traders should start by trading minimum position size. Once you have a set of results and stats from trades that you have taken over a period of time then you can verify whether or not your system has an edge.

Once you are trading that system consistently and profitably then you can start increasing your position size per trade. You can start scaling up your business and making some real money.

You should also know your gain per trade. That is, given your position size, how much would you win on average per trade?

Taking into consideration your wins and your losses, what is the positive expectation that you have in numeric terms for each trade?

Example of one of my trading systems:

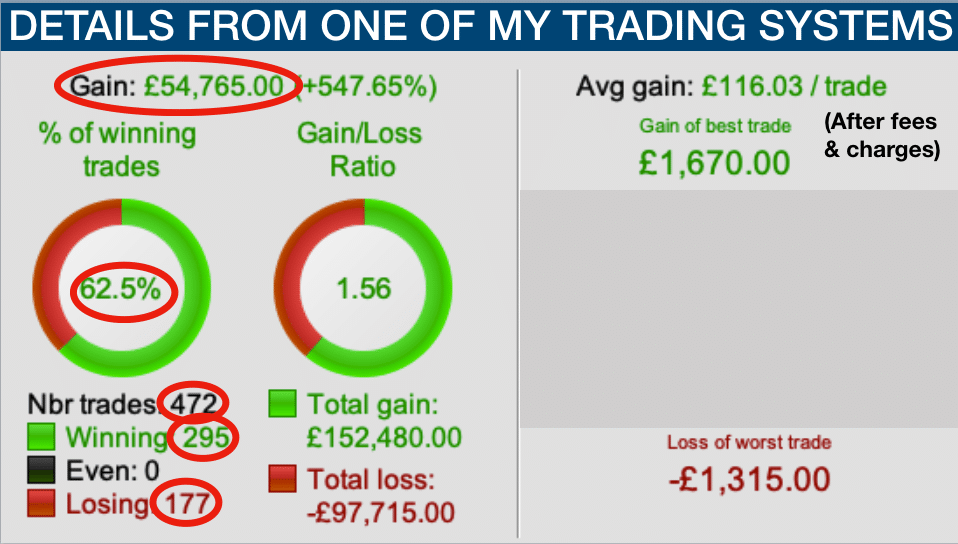

For example one of my systems currently has a win rate of 2.66 points (average) per trade – see the above stats.

So based on trades at a position size of £50 per point, the average win per trade is £116.03.

This is based on 472 trades (a substantial number), including 295 winners and 177 losers. This system has an overall win rate of 62.5%, a total gain of £54,765 over a 100,000 unit period (100,000 minutes – or three months based on my 1 minute candle system).

You should also be able to look back at your trades for the day, week, month and easily pick them out on your chart. Some broker trading software systems have this facility built in to them.

This type of functionality allows you to scroll back on your charts to view where you entered and exited each trade. This allows you to see where you executed the trade perfectly, and where you may have made a mistake.

Trading is always easier mentally when you know that you have a profitable system and all you then have to concentrate on is trading correctly in line with your system. If you have a winning day then that is all part of a bigger picture, even a losing day can be viewed as a step towards the end result.

It also means that when you are thinking of tweaking your system you can look back on past trades to see what impact the changes would have had.

I recommend putting all of your trade data onto a spreadsheet.

These are the basic trading figures that you should record

Record:

- Trade entries

- Trade exits

- A brief description of the trade, what went well, not so well etc.

This is the way to improve.

Trading is a constant process of improvement – Constant and never ending improvement – as Anthony Robbins called it.

Rate each trade according to how well you executed it. Record that data too. You may never have a day when you get 5/5 for every trade, but it is something to strive for. It takes the focus away from the money aspect and towards improvement. Record this data too. You can then look back and see where you have improved over time.

If you are currently losing money trading or just about breaking even then how do you feel about me asking you to record details of your trades? Do you notice any resistance internally to my suggestion? If you do then you are not alone. It is quite natural. Our mind tends to encourage us to avoid things that bring us pain. Looking back over losing trades and losing periods of trading can be quite painful and this can lead to internal resistance. Just know that it is the only way forward.

Commit to recording each trade that you take, starting today. It need only take a couple of minutes per day. Make the decision to do it and make a habit of it.

I promise you, this will take your trading forward and in the end it will significantly contribute to your profitability.

[fusion_youtube id=”uxHwSmTsFYU” alignment=”center” width=”” height=”” autoplay=”false” api_params=”&rel=0″ hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” css_id=””][/fusion_youtube]