Stocks in Play are volatile

Day traders trade Stocks in Play. The reason for this is because Stocks in Play move, they are volatile enough to produce good risk and reward trading opportunities for both bull and bear traders intraday.

Most company stocks have very little volatility. They normally move extremely slowly and they only produce big price swings when the company produces good or bad trading results, which may only happen a couple of times a year at best.

If you are an investor then you may buy shares in a company that has good prospects and who’s shares are moving steadily in the right direction. Investors are looking for good returns over a long period of time, so they don’t mind if a share doesn’t move much intraday.

Day traders require more action than this. Day traders will buy or sell shares during the stock market opening hours and they will exit the trade normally before the end of the day and sometimes even within a few minutes of opening the trade.

Inevitably stockbrokers charge fees for buying and selling shares and so day traders need price swings in stocks that will make their trade worthwhile and that will leave enough room for profits after they have paid any associated fees.

Stocks in Play have large volume

Liquidity is also a prerequisite for Stocks in Play. Since day traders are looking for quick entries and exits they need their stocks to be liquid. This means that they need to be able to buy or sell shares in the stock on demand.

If a stock does not have good liquidity then it may take some time before a broker is able to negotiate a deal to buy or sell a stock and the broker may not be able to get the sell or buy price that the trader is looking for. This is a problem for day traders and it could mean the difference between a profitable and non-profitable trade.

Traders have different rules for what constitutes liquidity and a good guide is the volume of trades and volume of shares that are traded each day. 100,000 shares traded per day would be a minimum for most traders and some require 1,000,000.

Which stocks are in play?

On any one day the Stocks in Play will change. Company news is often released early in the morning and good or bad news may well put an ordinary stock into play.

On any one day the Stocks in Play will change. Company news is often released early in the morning and good or bad news may well put an ordinary stock into play.

For example on the day that I write this article Thomas Cook, a travel company hit the news when they reported a trading loss. They accompanied the news of the loss with an announcement of holiday price rises. Their shares have fallen 10% so far today.

You can see on the 30 minute timeframe chart how the Thomas Cook share prices plunged today. Great news for traders, not so good news for investors. Thomas Cook daily share volume is normally between 1 million and 5 million and today it is over 15 million!

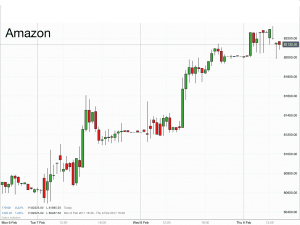

Some of the largest companies have stocks that are constantly in play, like Amazon, Apple, Facebook, BP, Barclays, HSBC. These are stocks that day traders will have constantly in the back of their mind (and probably on their trading monitors), looking for good trading opportunities and good levels to trade from. They have large volume of both trades and traded shares.

In the chart alongside you can see Amazon shares rising steadily on the 30 minute timeframe over several days. Amazon has a daily volume of shares that is constantly exceeding 1 million, even with a share price of currently over $819.

How to find Stocks in Play?

Most broker platforms now have a section for trending shares – these will often list a number of shares that are currently trending or have trended in the day so far.

Websites like Marketwatch (US shares), produce free stock screening tools to help you find stocks that are moving rapidly, breaking out pre-market and intraday. ADVFN produce toplists for trending UK shares and breakout shares. They also have access to apps with live news feeds like Seeking Alpha.

News channels like CNN, Bloomberg, Reuters and BBC are fairly quick to report large company news and breaking news. Stocktwits also provide up to the minute and relevant news for day traders.

How to trade Stocks in Play?

I trade Stocks in Play just like I trade indices and Forex, I use technical chart analysis as I teach on our Trading Training Course.

I make breakout, pullback and reversal trades and I use the price action to tell me where the market is going to go.

As I mentioned above some Stocks become “in play” as a result of news announcements. Trading news announcements can work for some traders. I find it less reliable than using my knowledge of price action though.

It may seem obvious that a company produces bad results and their share price goes down, right? Well maybe it does and maybe it doesn’t. Markets can behave in strange ways. Sometimes share prices rise on bad news as the news is not as bad as the market had expected. The market had previously priced in the expectations of bad news and they were pleasantly surprised. For this reason I tend not to trade using news or fundamental analysis alone when trading intraday.[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]