In the last part of this trading secrets programme we discussed how our perceptions are a brain creation, a representation of reality and not reality itself.

The reality in trading is that whichever market that you are trading, and at any point you never know for certain which way it will turn next. You may think that you know, however you are basing this decision upon your knowledge and your beliefs and someone somewhere else in the world will have a different point of view. The thing is that if they have more money and experience than you then you will probably be wrong!

One of the keys in trading is to consider what the major players are thinking, what strategy they are likely to be using and do what you think that they will be doing rather than what may seem to be the most obvious thing to do. The markets move with the money players.

Trading is a game of smoke and mirrors

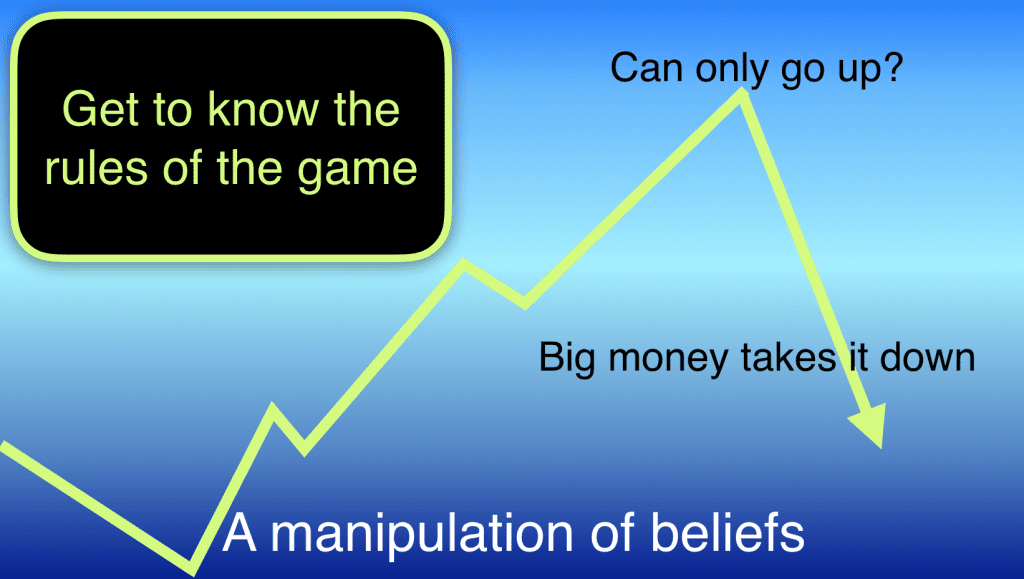

Trading is a game of strategy, it is a game of smoke and mirrors. When it seems like the market can only go in one direction amateurs take impulse trades in the direction that their beliefs tell them to go and sit at their computers in shock as the market reverses at the very moment that they place their trade. “You have got to be kidding” they say to themselves. “The market is out to get me!” This is true. Yes, the other market players are out to get our money, this is exactly the point. There is always someone else on the other side of our trade with different beliefs to us.

The way to play the game of trading is to know the rules of the game. Know and understand the strategies that pro traders use and adopt those strategies for yourself. There will always be plenty of losers to take the other side of our trades.

Beliefs are important in the game of trading. People act upon beliefs, traders take trades based on beliefs that the market is going to go up or down. Therefore there is money to be made from understanding how beliefs are formed and when the market is directing beliefs in the least probable direction. This is one of the rules of the game.

Example – How beliefs form in trading

Let me give you an example. After a big down day the day before the market opens with a huge bullish candlestick. It is the biggest candlestick on the chart, and as we watch it form we see it grow and grow and grow. It is easy to lose track of perspective in trading and we see these massive candlesticks forming and we say to ourselves “It is going to be an up day today.” A belief is forming.

The candlestick grows some more. This part is important because it confirms the belief in the mind of the trader. “There you go. I was right, it is going to be an up day.” When we have evidence for our beliefs they no longer stay as suspicions in our brain, they become reality for us.

As soon as we form a belief that the market is going up we get an impulse to trade. What is the point in waiting? If we think that the market is going up then we need to get into the trade right? If we wait then we will only lose out on making money.

All is not as it seems in trading

Amateur traders act upon impulses and this is a problem. It is a problem because all is not as it seems in the market.

Professionals never take trades based on impulse. They have a system and they follow it. They understand the signals that a market gives that create beliefs in the minds of lesser traders. They wait and watch amateurs trading in the direction of the latest market surge. They see the market slowing or reaching a resistance level and then they pounce. They trade against the amateurs.

Markets that are bearish in sentiment have periods where they go up as well as down. Markets that are bullish have periods where they go down as well as up. The thing is that if a general market sentiment is bearish and the market goes up strongly it will probably fall even more strongly.

Pro traders keep a general perspective on the market and they see the massive bullish candlestick appearing at the beginning of the day. They know that there are more bears in the market than bulls. They know that the bears are waiting for an opportunity to pounce. When the market gives a signal they all pounce at once and the market turns on its heals.

The amateurs who traded long upon seeing the market opening up watch in horror as their trades turn against them. “I’ll wait. The market is going up. I decided that a few minutes ago.”

Eventually their pain becomes too intense or their protective stops get hit and they get out of their long trades. This has the impact of intensifying the speed of the market descent. Now the market is one sided there are only sellers. the market plummets. The pros make another great killing in the market.

The pros make their fortunes from understanding the mechanics of this type of move. They understand their own minds well enough to know when their beliefs are forming. They maintain perspective on their beliefs and are able to assess the other side of trades. They only act upon triggers set by their trading systems. They understand how beliefs form and what type of market action is likely to create beliefs that are probably wrong. These are the rules of the game.

Most of the time markets are about evenly weighted between buyers and sellers. At times like these there is an equal chance of the market going in either direction. However there are several times every day where markets are not even, there are either more buyers or sellers about to take trades. At times like these the probability is weighted in one direction or the other and the thing is that the direction of greatest probability is not necessarily the most obvious direction at the time. As home based traders, these are the opportunities that we must understand and that we must take.[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]