Rounding bottoms also sometimes come in the shape of a cup and handle and so are referred to as either a Rounding Bottom or a Cup & Handle chart pattern.

The name rounding bottom implies that it is a pattern that occurs after a downward price move. This isn’t always the case. The best performing Rounding Bottoms form a pause in an upward price move and they can also work out after a downward move. It is worth keeping an open mind.

Identifying Rounding Bottoms

The key with identifying this chart pattern is to view it on a timeframe that is five times larger than the one that you are trading. So if you trade a daily chart then view the formation on a weekly chart. If you trade on a five minute chart then view the pattern on a thirty minute chart (assuming that you don’t have access to 25 minute charts). This provides perspective.

These can be quite long patterns. In fact, the longer the better.

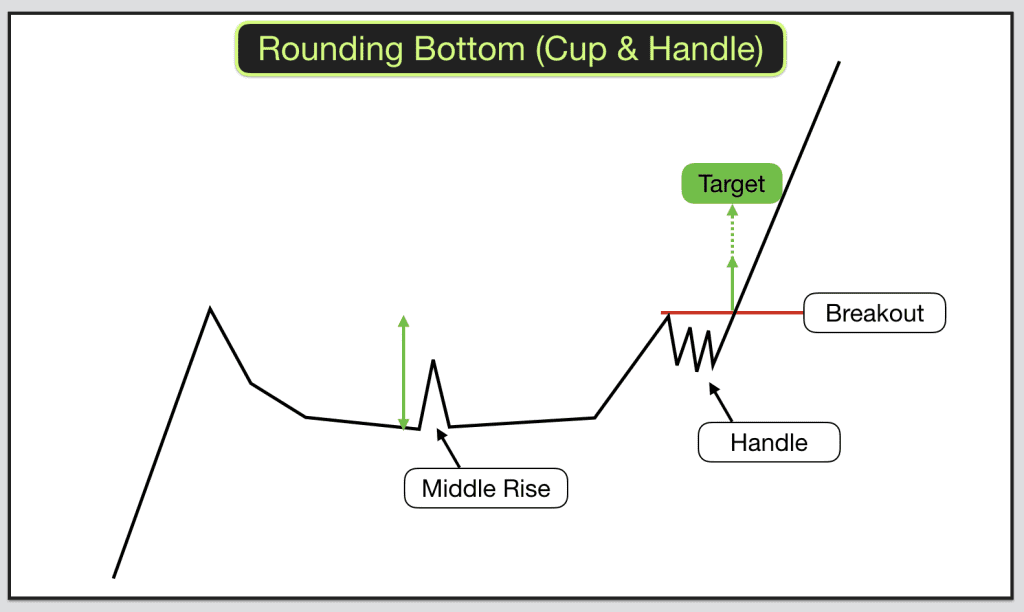

We are looking for quite a smooth and rounding bottom formation. Firstly you will see the left lip of the cup. Price will fall away from the left lip to a bottom, rounding as it progresses.

Fairly frequently there is a temporary price rise in the middle of the cup. This should be short lived and price should fall back to the bottom of the cup again.

Eventually price moves into the upward phase of the rounding bottom, curving upwards. A gentle rounding curve is what we are looking for.

Frequently there is a right lip to the cup (rounding bottom). This will form around the same level as the left lip. It may be followed by a handle formation. The handle is one or a series of short, sharp downward moves followed by short sharp upward moves.

Trading Rounding Bottoms

There are several possible trades associated with rounding bottoms.

Swing traders will trade the move off the bottom of the cup. As price starts rising off the bottom swing traders buy. The trade for this is up to the level of the left lip.

If you take this trade bear in mind the possibility of the quick temporary rise in the middle of the cup. Some swing traders will also trade price back down to the bottom of the cup after this temporary rise.

The other trade is the final breakout. This occurs when price closes above the level of the right lip (or left lip if the right lip doesn’t materialise).

The target for this trade is half the height of the cup from the bottom to the right lip (or left one if the right doesn’t appear). Wait for a slowdown in price rising before exiting at this target as a good proportion of these patterns make the full height of the cup target.