Once the exclusive domain of the institutional traders commodity markets are now easily accessible to independent traders.

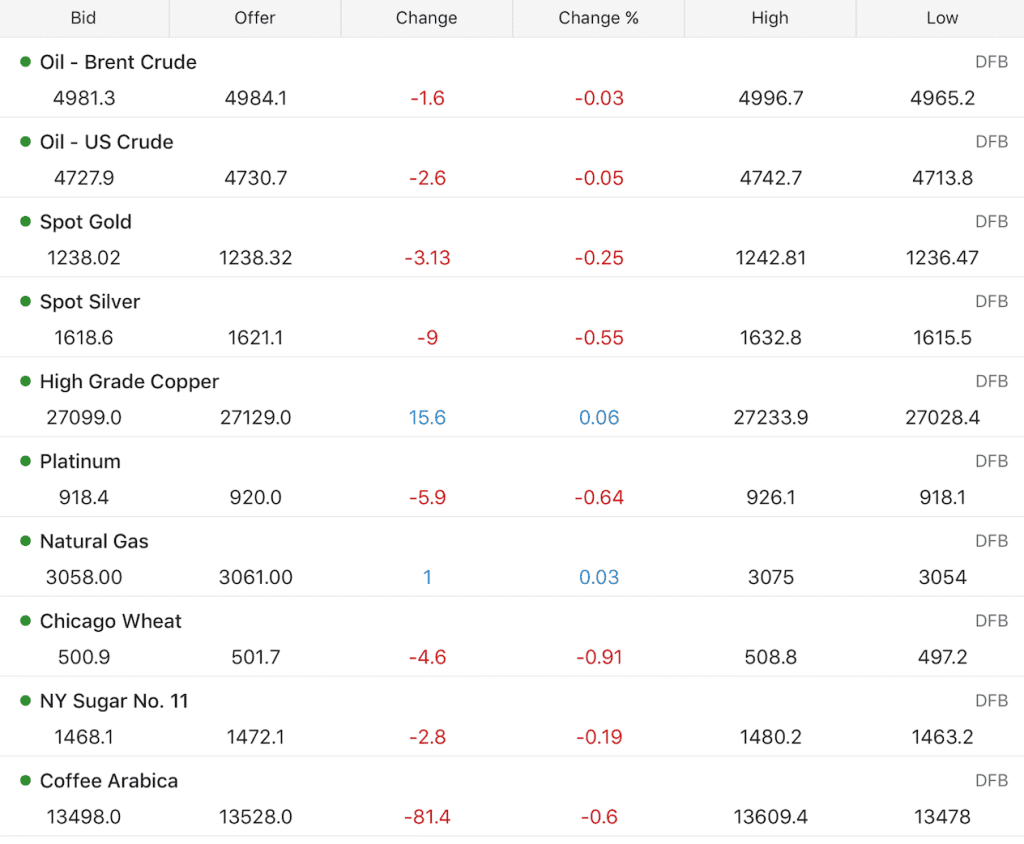

There are a huge variety of commodity markets to trade. From gold, silver, copper and oil to coffee, avocado, wheat and sugar.

One of the key factors in trading commodities is the impact of supply and demand. Prices of resources like oil are highly influenced by supply agreements amongst producers and this can offer excellent news based trading opportunities.

How to buy and sell commodities

As with stocks there are several ways to trade commodities the most common way is via commodity futures markets and Exchange Traded Funds (ETFs). Futures markets are derivatives and consist of contracts to buy and sell stocks and goods. The contracts are traded amongst buyers and sellers and a fluctuating price exists for these contracts.

Like all derivatives, when you buy a commodity via this route the only thing that you own is the contract itself rather than the physical goods. Futures markets effectively track the real price of the commodities and institutional traders will take advantage of any difference between the two, leading to any difference being minimal and short lived.

Exchange Traded Funds (ETFs) are traded like stocks via a central exchange. These funds too tend to mirror the price of the real goods or assets.

For non US based traders commodities and commodity markets can also be accessed using wrappers like CFDs and Spreadbets.

Advantages and risks in trading commodities

Commodity markets are highly liquid. This means that traders can easily find other buyers and sellers so that they can enter and exit trades quickly.

As commodity markets are highly influenced by supply and demand they can produce long term momentum swings and trends which are sought after by traders.

Often commodity markets have a direct relationship with other markets, especially indices.

EG the FTSE 100 index has a number of oil producers in it, so often when oil prices are going up the FTSE tends to do the same and when oil prices go down the FTSE will also go down.

Gold tends to have an inverse relationship with stocks. When stockmarkets are rising the price of gold tends to fall. Investors perceive that they can get a better return by investing in the stockmarket rather than gold. Gold is also seen as a safe haven, so when stockmarkets are falling gold prices tend to rise.

Broker fees and spreads for trading commodity markets are fairly reasonable as the markets are liquid and futures and ETFs are easily accessible.

Commodities can be traded using margin, so traders are only required to produce a small deposit in purchasing the contracts. As with all trades involving margin the risks are not limited to the deposit.

Since commodity prices are highly important to various world economies they may be supported by government funds and supply agreements. Retail traders tend to be the last to hear when big announcements are made and overnight and out of session price changes are frequent. This could be to the advantage or disadvantage to a retail trader depending on what side of the trade we are on. Essentially it increases the risk.

Short term traders and Day Traders use technical analysis of chart patterns in commodity markets to pin point possible trading opportunities – Learn how to trade commodities and other markets with our trading training courses.