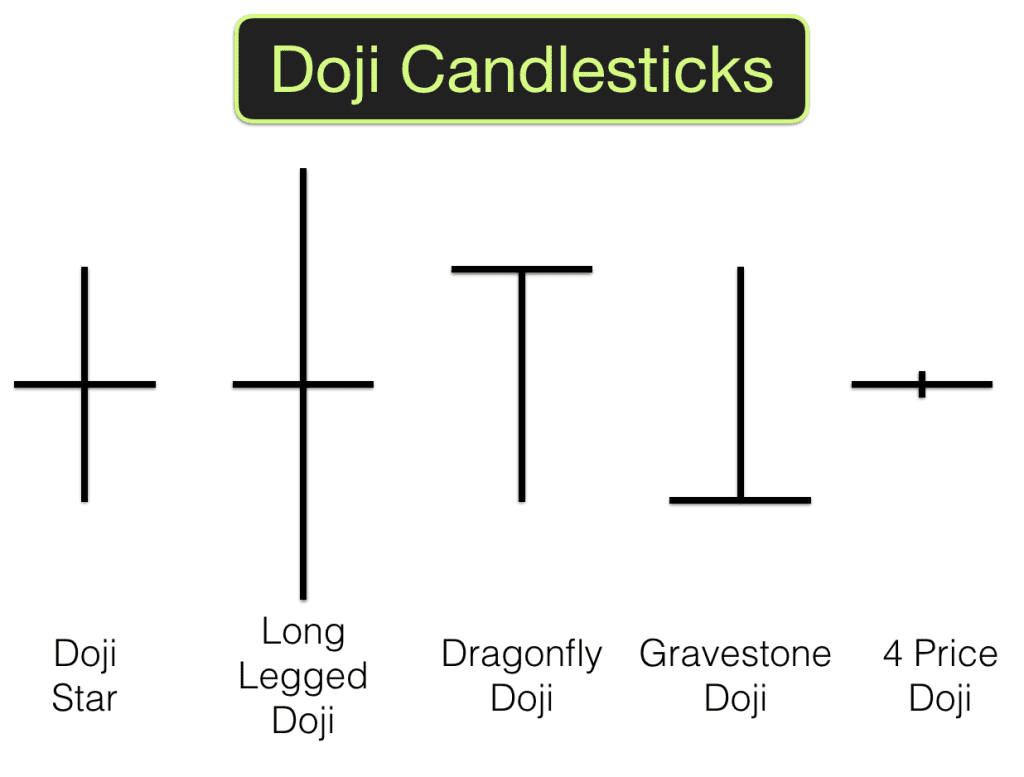

These strangely named Doji candlesticks often look like a cross. They may have a long nose and a short tail or a long tail and a short nose or identical sized nose and tail. The key to identifying them is that the body of the candle is very small or hardly noticeable.

As the body of the candle is so small we can gather that neither buyers nor sellers have had control over the period of this candlestick. Price closes near to or exactly at the opening price of the candle.

These candles may signal a change in market direction or it may be a pause. They certainly do signal some kind of change if the previous candles have been all of a similar colour and the market has moved strongly in one direction. Quite often one Doji candlestick is followed by another short candle or a Doji as the pause continues before either buyers or sellers re-establish control.

Trading Doji Candlesticks

Some traders see Doji candlesticks as trading signals. In my experience they are more frequent and less reliable than Pin Bars at identifying reversals. Similar to Pin Bars it is always worth waiting for confirmation before using them as trading signals. They could be the first in a number of factors that are useful in identifying continuation or momentum trades or reversals.

Often when in doubt over the meaning of a Doji candle it can be useful to change the timeframe of the chart to see what type of candles are forming on a higher timeframe.

Eg You are looking at the 5 minute chart, see a Doji, you can then see more clearly what it may mean by looking at the 10 minute chart. What type of candle do you see on the higher timeframe? A pin bar? An engulfing candle? Nothing in particular of note?

Effectively at the end of a Doji candle we are as we were at the end of the previous candle. It puts us on alert. Something may be changing. Wait and see what develops.

Learn how to trade Doji candlesticks within a profitable trading system on our Stocks & Forex Trading Training Course.