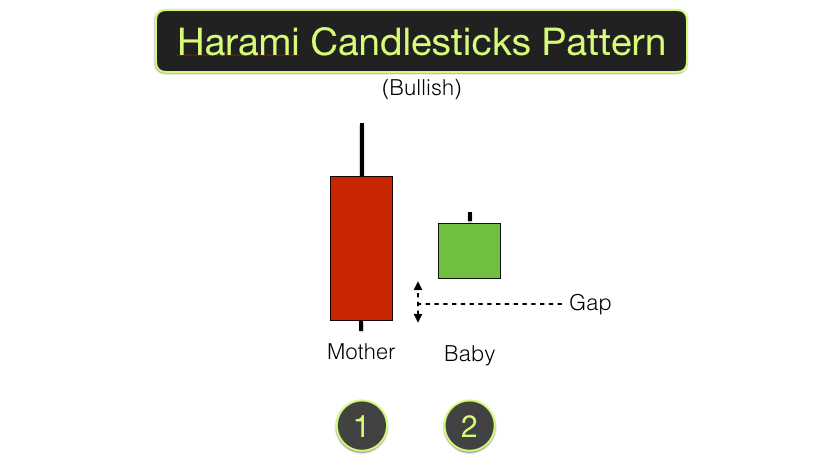

A Harami candlestick pattern constitutes two candles. A larger candle followed by a smaller candle. The smaller candle rests alongside the midriff of the larger candle. In order for this to occur there needs to have been a gap in prices between the opening price of the second bar and the closing price of the first bar. A essentially we have a mother candle and an unborn baby candle in the stomach of the first candle.

At bottoms the first candle will be bearish (red). We then see a gap up in price with the second candle being a small candle sitting alongside and inside the body of the first candle.

At tops the first candle will be bullish (green). We then see a gap down in price with the second candle being a small candle sitting alongside and inside the body of the first candle.

The second candle can actually be the same colour or opposite colour to the first candle. It is more likely to be the opposite colour since it will need to be inside the body of the previous candle in order to qualify.

Harami Candlestick Pattern

The key in terms of momentum and psychology here is that the price has gapped in the opposite direction to the way the market has been moving (against the trend). Any gap in price is significant. It indicates strength of feeling in the market place.

In order to gap in the opposite direction to the trend there must be strong feeling in the marketplace that prices are too high at tops and too low at bottoms.

A pause after the gap, evidenced by the small second candle indicates that the market participants are taking stock of the situation. If the previous trend is to continue then the pause will be followed by a move downwards.

A possible reversal will be signalled by the next candlestick continuing the move in the direction of the second candlestick (the baby) in the pattern.

I find Harami candlesticks of most value when trading Forex markets. They are widely traded in Forex and the following move tends to have good momentum. Learn to recognise & trade specific signals and design your own profitable trading plan with our Trading Training – online course.