Flags and Pennants are a series of tight and short price bars that often appear about 50% of the way through a sharp price move. I find that they provide excellent risk and reward trades.

They may appear in bullish up moves or bearish down moves and they represent a small congestion area, a pause before the second leg of the move. The congestion area looks like a flag or a pennant with the run up or run down to the pattern representing the flag pole.

Identifying Flags and Pennants

You identify flags and pennants by drawing two trendlines along the tops and bottoms of the congestion area. As with all trendlines you need two points of contact to form the line so with flags and pennants you will need four points of contact in total. Two for the upper line and two for the lower.

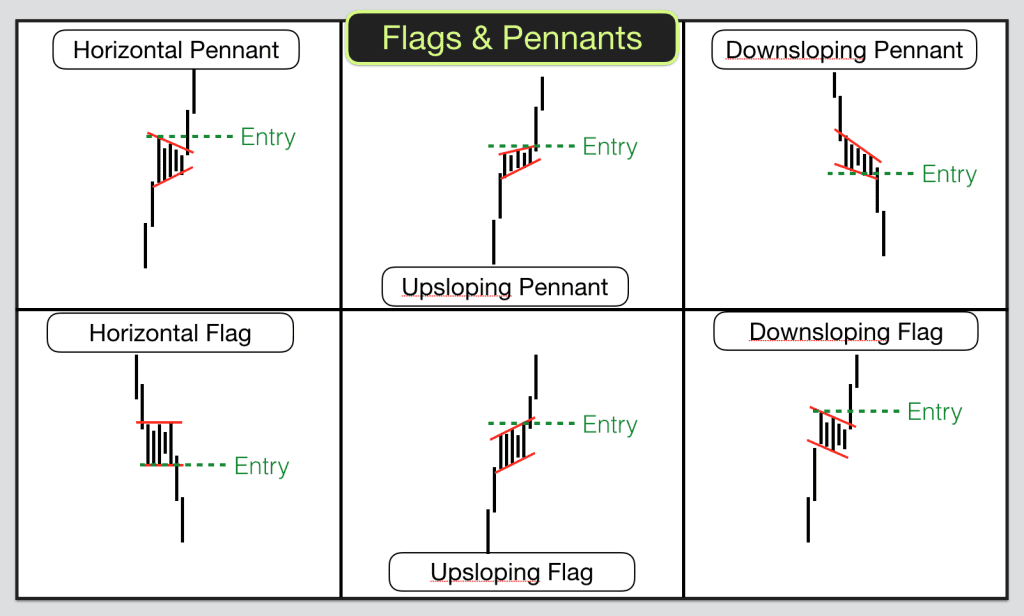

Pennants are mini narrowing wedges. The upper and lower trendlines converge.

Flags have parallel trendlines.

Either type can ascend or descend, they are either horizontal, upsloping, or downsloping.

In order to form a flag or pennant price must make a strong move up or down. This initial strong move forms the pole.

Trading Flags and Pennants:

When price breaks the top of the patten in up moves this confirms the pattern and this is your entry point. You should place your stop below the lowest low in the pattern

When price breaks the bottom of the pattern in down moves this confirms the pattern and this is your entry point. You should place your stop above the highest high point of the pattern.

Before trading you should check to ensure that there are no strong overhead resistance or underlying support levels.

Your target should be the next overhead resistance level or underlying support or 100% of the length of the flag pole. Measure down from the beginning of the flag or pennant to the start of the up move or measure up to the start of the down move.

They often provide excellent risk and reward trades because the risk is limited by the size of the congestion area and that is often small. Your reward is potentially the size of the full length of the run up or down to the pattern, which often large.

If you want to learn more about how to trade chart patterns and candlesticks, how to read price action on charts, then join us on our online trading courses.