In September 2018 I went live with my automatic trading system. I had designed a system that would take trades for me with real money on a live market. This was a real stretch for freedom for me. Would it be possible to trade hands-free and allow my (fairly simple) self-designed algorithm to make money for me and compete with the multi-million dollar institutional algos?

My system enters and exits trades for me given certain criteria that I have given it. It relies on technical analysis, chart reading and a couple of trading indicators to give it signals to risk my money in order to make short term trades and accumulate gains on the world stock markets.

The system has daily profit and loss limits which are designed to protect my capital resources and only takes trades during normal market hours (8am to 4.30pm UK time for the DAX).

For many years now I have been concentrating on day trading on the short term timeframes. My automatic trading system is designed specifically to work on the DAX (Germany 30) one minute charts. After months of testing and backtesting my algorithm I finally reached the point where I felt like I had an algorithm and automatic trading system that could replicate the trades that I had been taking manually to a good enough extent where I could trust it in the live markets, with my own money.

The first four weeks – live automatic trading system

We are now four weeks into my automatic trading experience. Largely I am happy with the way that my system has performed in the live environment. We have been stuck in a drawdown period for my system, which has persisted for two weeks now and I have been treading water since this drawdown period started but as you can see from the three month equity curve on the chart above, the prospects for capital growth once the drawdown period is over are excellent!

To date my automatic trading system has generated profits of +92 points.

The equity curve in the chart is of course based on a backtest version of my system. Over recent weeks I have been comparing the performance of the live system against the performance of my demo based backtest system (on which I designed and tested my algo). Largely I am happy with the way that the live system has performed in comparison. However there has been one thing in particular that has come to light which needs monitoring.

I am using IG as my broker and ProRealTime software to run the system. I have been experiencing slight slippage on some of my entries on the live system. This is something that does not occur on the demo backtest system as it always assumes perfect entry and exit. Ultimately I may need to adjust some parameters on my system to account for this if it proves to be persistent and damaging to my overall results.

Last week a small amount of slippage on one entry caused a loss for my system and cost me 23.6 points in total (as without the slippage it would have been a winning trade).

Slippage is something that occurs with all brokers, but I think the way that IG explain on their website and in my discussions with them does not justify the way that it operates on their live trading system in terms of trade entries. I am currently challenging them over this aspect.

Anyway, slippage aside I look forward to another week of automated trading.

Monday 29th October 2018 – Sabotaged by a missed exit!

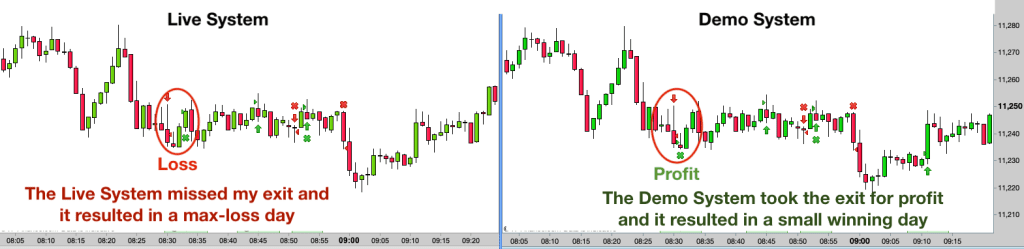

My system had a max-loss day today. It finished down 43 points and stopped trading at 9am. That is not the whole story though!

The first trade of the day was at 8.30am. My system took a short trade – you can see the entry candle in the picture above. The entry was on the big red pin bar in the circle.

As you will know, I run an identical demo system alongside my live system so that I can monitor any differences in performance. The demo system took the same trade, with the same entry.

The entry candle was large in comparison to previous candlesticks and one of my exit criteria is to take profits on trade after candlesticks that go in my favour and which are larger than average (1.5x the 14 period ATR). This candle met that criteria and therefore the system should have exited the trade at the close of the candle for a profit.

The demo system did exit at the correct time and did make a profit on the trade. The live system ignored the signal and remained in the trade, exiting three candlesticks later for a loss.

The loss was fairly small just a few points but the difference between the win that should have occured and the actual loss was 10 points.

The only explanation that I can think of is that the platform did not execute my order. I have raised a complaint with my broker over this.

As a result of this error, my live system ended the day with a max-loss, whereas the demo system (trading the same code and with the same criteria) went on to have a small winning day. Frustrating to say the least!

Tuesday 30th October 2018 – Slippage is taking its toll on my system

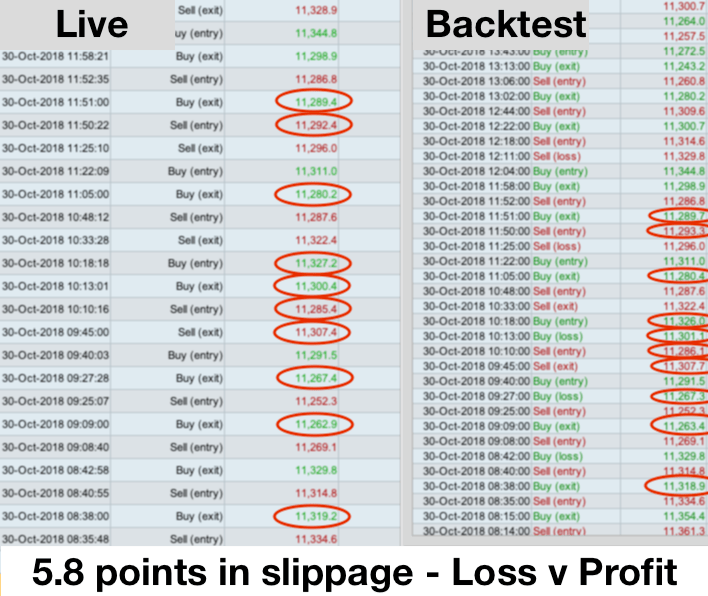

I hit max-loss again today, losing a further 38 points. This time the culprit was slippage. Slippage on entries and slippage on exits. It is time to take action!

Over the course of 13 trades that my system took today (26 orders) I suffered 5.8 points of slippage. This equates to 0.45 points of slippage per trade. It doesn’t sound much but my system exceeded its daily stop loss on the final trade today by a margin of 0.5 points. This means it stopped trading for the day at this level.

My backtest system, which trades the same automated code and the same live chart but doesn’t use real money and doesn’t suffer slippage, did not exceed the same stop loss point. It stayed under it (by 5.3 points). It then went on to make several profitable trades in a row and finished the day in profit. Thus the 5.8 points of slippage actually cost me far more than 5.8 points because of the way the system works.

I set the system stop-loss and take=profit levels using the backtest system. I now need to amend them to take account of slippage. This will make the system slightly less profitable than it would have been but should still produce really good results over the longer term.

In effect the changes that I am making will mean that my losing days are slightly bigger and winning days slightly smaller (the affect of slippage) but I should get stopped out for a loss on losing days less often.

I have now had two consecutive losing days which have been completely due to broker charges and software errors.

Fortunately I remain slightly in profit overall with my automated trading system and move forward with a better equipped system for future trading days.

Auto Trading update

Further to my note above. I have currently placed my automatic trading on hold as my broker, IG have so far been unable to provide an explanation to me as to what exactly occurred during my “missed” exit.

12th November update – IG have confirmed that my code was not at fault. I appears to be a glitch in the system and they say:

I have received a reply today, they say that it is not a coding error but instead an error in how the system handles the “EXITSHORT”(trade exit) part, the conditions were met but the system was unable to proceed due to limitations on the live system. It looks like it is an error on the current version of the live account.

Since this incident may not be an isolated one I have requested more information and an explanation as to when the system will be updated to fix the problem. I have also requested a refund of the loss to my account!!

I’ll update you once I have more information.