We are about to enter week 4 of my project – day trading with a self-designed robot. I am so excited about the future of this automated trading system, I can’t tell you!

Whilst I have been live trading with this automatic system I am up 56 points so far. I have had just six positive, winning days from the 14 days that it has been trading live. 6/14 winning days is below the average that I would expect for my system as it should be profitable on 2/3 days. I did extensive backtesting prior to setting the system live and the backtest results were phenomenal. You can see from the current backtest results in the chart above that all things being equal this is a hugely profitable system.

The equity curve above shows the daily results over a period of three months. What traders are looking for from a trading system is for the equity curve to be steadily increasing with very small periods of drawdown and this is exactly what this system delivers. Having said that it doesn’t mean that the system never draws down (erodes capital). Like every system it has periods where it does well and periods where it doesn’t do as well. We are currently in a drawdown period.

I find that it is always good to step back and take a look at the bigger picture, especially in terms of dealing with the emotions involved with trading. This drawdown period follows an exceptionally good period where the equity curve took off in parabolic fashion. Just like in price charts, parabolic moves are often followed by a pullback. The current drawdown is hopefully just a pullback to the mean for the system as it makes its way into greater and greater profitability and hopefully makes me plenty of money in the process!

See here: Week 1, week 2, week 3

Monday 22nd October 2018

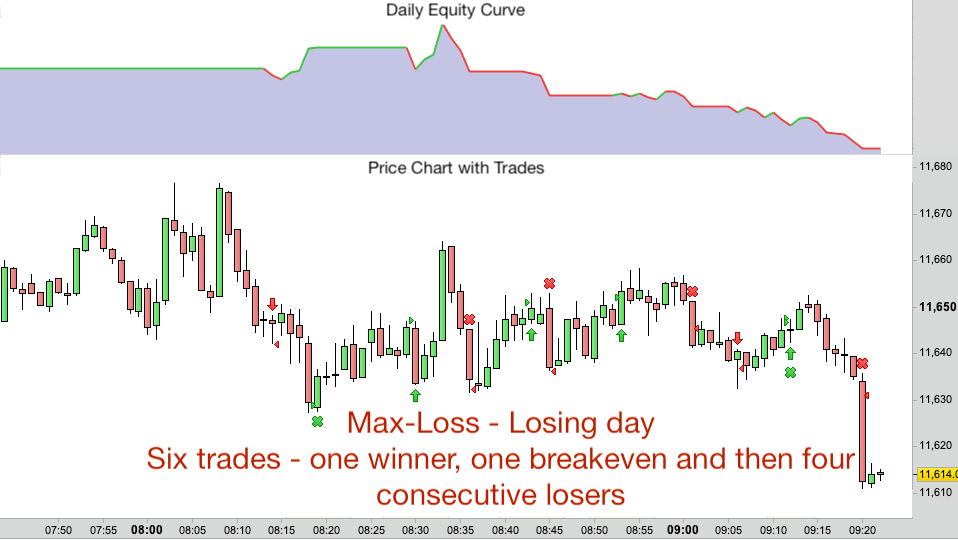

Equity curve, trades and 1 minute candlestick chart on the DAX 1 minute timeframe.

My trading robot started the week really well. I had a good winner first thing in a breakout from the early market trading range. I was hopeful that the day would continue in the same vein.

Market conditions have been especially tricky over the last 8 or so days. The market has been in a lull since the big falls of the week before last. On the weekly chart of the DAX (which is the market that my robot trades) the last week was an inside week at the low of a big red candlestick. These type of weeks make for choppy market conditions and plenty of false breakouts. Traders are reluctant to commit long or short to trades for any length of time and so the market gets stuck and doesn’t move far.

My system works best when the market is moving. It takes trades both long and short but the moves need to be long enough to generate some profit to make the reward to risk on my trades worthwhile. In small trading ranges the market just tends to oscillate up and down and it doesn’t go anywhere. This is where most short-term traders stack up losses.

At some stage this week I would expect the market to break free of the longer term range and if this happens then we will be back in profit mode. For now though the choppy conditions persist and no longer had the market broken out of one range it created and got trapped in another today. My early win was wiped out and we (my trading robot and I) then went on to have four consecutive big losses. After this the system hit max-loss and stopped trading for the day, I am down nearly 50 points on the day.

This still leaves the system in profit overall by 5 points but I am seriously hoping that the market improves some time soon! :)

Tuesday 23rd October 2018

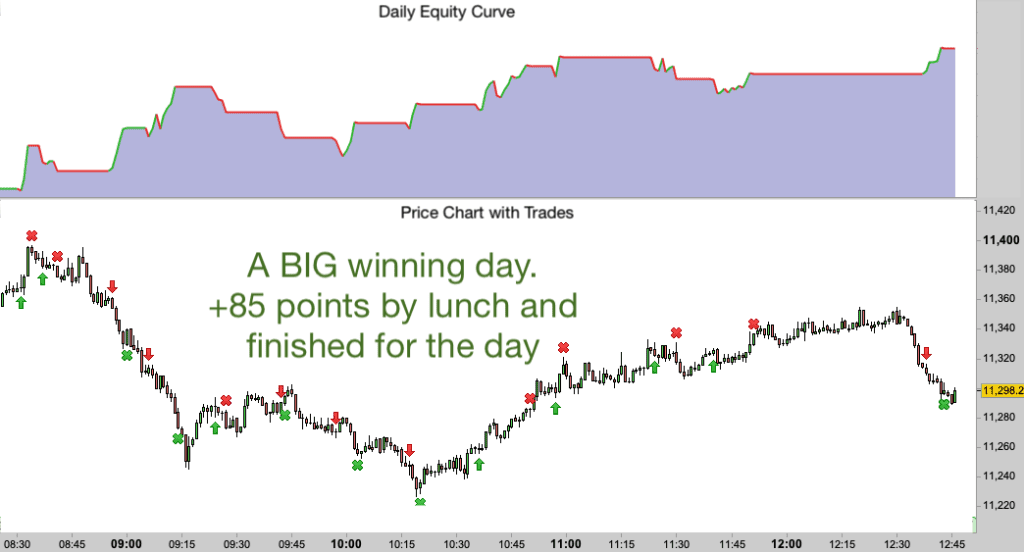

A BIG winning day at last!!

We have hit Max-Profit today by lunchtime and my system now takes the rest of the day off. We are up 85 points today and so despite the last two days being losers we are actually about breakeven for the three day period. This shows the value of ensuring a good reward to risk in setting daily profit and loss limits as well as in each trade in isolation. My max-profit is 2x my max-loss.

Even with only 7 winning days out of 16 trading days my system is standing me 90 points in profit.

Today we got the market breakout (from last weeks trading range) that I predicted yesterday. This opened up trading conditions this morning and we saw big swings downwards and upwards, we took trades in both directions and made profits from them.

As you may know if you have been reading other blogs from this series, I have an identical system running on my demo account. This allows me to compare the performance between my live system that I am reporting on here and a demo system. I can then easily see how slippage (a broker charge) is affecting my trading results as the demo version of the charts does not suffer slippage (I know, it could be construed as misleading!).

My demo system hit max-profit about an hour before my live system today. At the time my live system was about three points away from maxing out. Therefore I could conclude that slippage had cost me three points in the first 10 trades. This was really frustrating at the time and got even more serious when the next trade on my live system was a loser! My demo account didn’t take that trade as it was sitting idle having finished for the day.

However all ended well as the live system finished with two winners and actually made three points more than the demo by the time it shut itself down. Swings and roundabouts, but I would not have been happy if I had had to sit through my system losing money all afternoon having missed max=profit level by three points due to the cost of slippage!

Time for a walk in the sunshine and I am hoping the better trading conditions continue into tomorrow!

Wednesday 24th October 2018

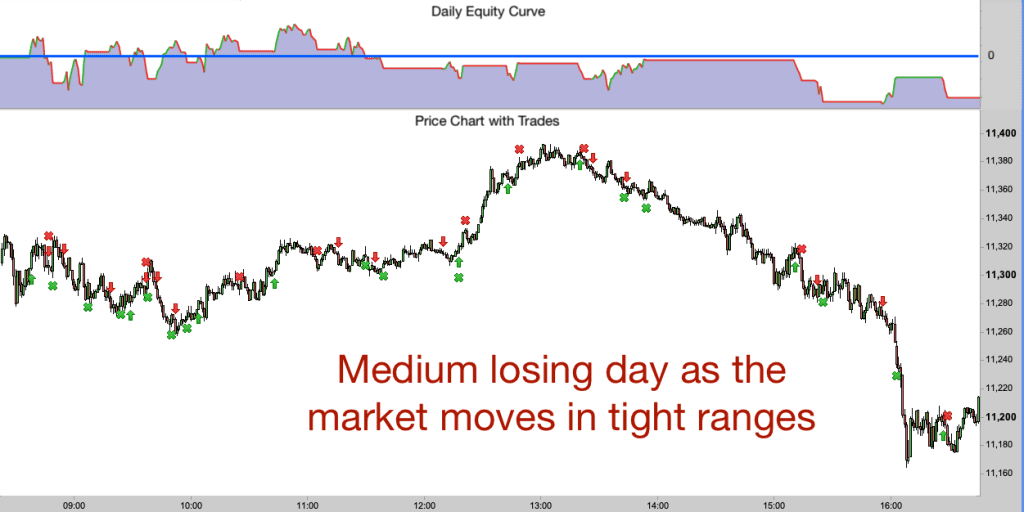

For most of the day my system dealt well with the reasonably choppy market conditions today. During the morning we were oscillating around the breakeven point for the day as the market got stuck at the recent low of 11,300. Everything was still in the balance approaching the US markets open at 2.30 and then a couple of losing trades which triggered against the trend dragged us into negative territory. We finished the day down 29 points.

I call trading days like this trending trading range days. The market gets stuck in tight sloping channels or horizontal ranges, breaks out violently for a short time and then gets stuck again.

You can see from the chart that the morning consisted of a downward sloping channel to 10am and then an upward sloping channel to midday, before breaking out sharply higher. We briefly reached the 11,400 level and this was the trigger for the market to turn.

The afternoon was basically a downtrend but it had quite large pullbacks in it that trapped me out several times and caused full position losses. Thus the losing end to the day.

Still, a winning day yesterday of 85 points versus a loss of 29 points today is a good win to loss ratio and I’ll take that positive thought into tomorrow.

Thursday 25th October 2018 – Suffering from a trading demon – Slippage

My self-designed trading robot suffered at the hands of slippage today. Slippage is effectively a broker charge and occurs when they fail to complete an order at the level that their customer (my robot – in my case) requests.

As you may know from reading these blogs I run an identical demo system alongside my live trading robot so that I can measure the difference between the them in terms of results. In theory the performance should be equal, however the demo system lives in an ideal trading world and it doesn’t take account of slippage.

Slippage with my broker, IG is often minimal and in fact I have noticed that most trades and orders are executed without slippage. However when it occurs it can be punishing.

You can see from the screenshot above that my system entered a buy order (entry) at 09:00 (the bottom order on the table). The two systems were both set to enter on an identical stop order at a level above the last candlestick high. The order was set to take effect at 11,192.9. As you can see, the demo system effected this order perfectly, however the live system did not. It made the entry at 11,194.3. The slippage in this case was 11,194.3-11,192.9=1.4 points.

1.4 points may not seem like a huge deal, but the effect of it did cost me a total of 23.6 points. My live trade stopped out at 15 points loss on the entry candle. This system based loss limit is defined based on correct and accurate entries. The demo system did not stop out as the entry candle did not drop 15 points from the correct entry point. It stopped just short. The demo system then went on to record a winning trade and exited at 11,201.5, three minutes later – a win of 8.6 points.

You can also see that the next trade suffered slippage on entry too, in this case the difference was 0.9 points (11,199.6 v 11,200.5). In this case both trades were winners, but the live system recorded a smaller win due to the slippage charge.

The challenge now is, what do I do about it if anything? If slippage was consistent on each trade then I could make small alterations to the system with that in mind. However in most cases the trades do execute without slippage, so it is a tricky conundrum. It is all part of the challenge and I’ll be pondering it!

In the end it was a losing day for my system. A loss of 52 points and we shut down for the day before 10am at max-loss. The current drawdown period continues and takes me back to just above breakeven for the 4 week period of trading with my robot.

Friday 26th October 2018 – Ending the trading week positively with a big winning day

A big winning day on a Friday always puts a smile on my face. I’m smiling today! My trading robot finished this Friday up 82 points on the day as we reached max=profit point by 12.30pm.

[fusion_table fusion_table_type=”1″ hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

| Day | Result (Points) | Cumulative Gain/Loss (Points) |

|---|---|---|

| Monday | -50 | +6 |

| Tuesday | +85 | +91 |

| Wednesday | -29 | +62 |

| Thursday | -52 | +10 |

| Friday | +82 | +92 |

[/fusion_table]

The table above shows the results for the week. It has been a positive week overall. We started up a cumulative total of 56 points and ended it up 92 points cumulatively.

It hasn’t felt like a winning week though. We actually had three losing days and just two winning days. The key to the success this week has been the fact that my system is programmed to allow the winning days to grow to a bigger level than the losing days.

Some days the market conditions just do not suit this particular system, on other days they suit it really well. On the days where things are not working then it makes sense to give the system an early bath! On better days I am prepared to risk what we have gained in order to gain more. This is how the system works.

You will notice from today’s chart that the market was creating big up and down swings. This suited my system really well. On other days this week the market was making much narrower swings and there was not room for my trades to work out in my favour before a deep pullback would either stop me out for a loss, or trigger a trade counter-trend and in the wrong direction.

Whilst I have been live trading with my robot the system has so far been running at a win rate of just under 48% and still making money. This win rate is well below the average for this system. I would expect a win rate of 53-55% over the longer term, so there is a suggestion that even better times are around the corner for my automated trading system in weeks ahead!

Have a great weekend traders.