Continuing our series on Trading Secrets – All in the Mind, in this part 3 we discuss here how to begin to master the emotional side of trading.

We can absorb millions of bits of information per second though our senses. In terms of trading most of that information is taken in through our sense of sight. However we have a maximum capacity for the amount of information that we can process at any one time.

Our brains can only handle a limited amount of information and if we overload it by trying to process too much information at once then it compensates by starting to delete things, distort things, generalise things, and we end up feeling overloaded and confused, we make mistakes. When our brains delete things it means that we ignore potentially important information, information that we could be using in order to make better trading decisions.

When we make mistakes we think that we need to concentrate even harder on making better decisions. This has the effect of increasing the amount of information that we are attempting to process and in turn it means that we forget to take into consideration some of the fundamental aspects of our trading strategies. This is why we need to keep trading simple and trade by a simple set of rules.

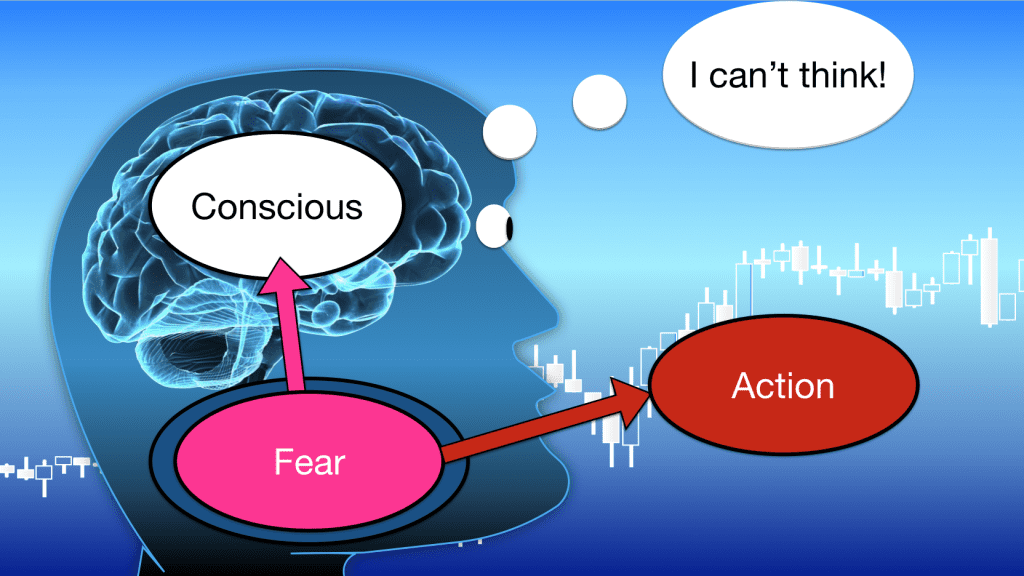

When we experience a high level of emotion in trading our brains are consumed by this emotion. It uses up all of the brains capacity and there isn’t any room left for logical decision making. Emotional trading is often decision-less trading. In this state we revert to our subconscious processes. We revert to old habits and we do what comes naturally to us. This is why professional traders revert to amateur trader habits when they get caught up in emotion.

Two way communication process of the mind

Let me explain how this works:

We have two parts to our brain, one part is conscious and in our awareness and the other part is subconscious and out of our awareness.

There is a two way communication process going on between our conscious and subconscious. Effectively we use our conscious thoughts to guide our subconscious. In that way our conscious brain is like a steering wheel for our subconscious brain. We direct our subconscious using our conscious thoughts.

However in the other direction our subconscious brain steps in when it thinks that it needs to protect us or when it thinks that it can be useful to us. It notices something that is outside of our conscious awareness and if it thinks that we should be aware of this thing consciously then it lets us know. Two things can then happen: we get thoughts about this thing or we don’t get thoughts and we just take action automatically.

This two way process is extremely effective in some ways, it keeps us alive and helps us to achieve our objectives and it can also cause us problems.

Thinking then about our conscious awareness. It is easy to think that we are fully aware of everything that is going on around us, however this is not the case. As an example, did you notice how deeply you are breathing before I just mentioned it? In fact you are not breathing deliberately are you? Did you notice how comfortable your left legs is at the moment before I just made the suggestion? Probably not.

There are lots of things going on around us that we are not consciously aware of. Our subconscious notices everything but we only become consciously aware of things that we focus on.

Our conscious brain as a processing unit has a limited capacity and so we filter information away in order that we can concentrate only on dealing with the information that our subconscious thinks will be most useful to us.

We have two input functions then to our conscious brain, external inputs, information that we receive through our senses and internal inputs, thoughts.

In any one moment in time we are taking in information through each of our senses. In trading most of the information is taken in through our eyes and sense of sight.

Mind filtering process

We filter the information that we take in so that we end up with a representation or perception of that information. What is important here is that the perception that we end up with is not the actual information that we take in. It is a filtered version of that information. What we perceive is not the reality. It is our representation of reality.

The filters that we have serve the purpose for us of limiting the number of bits of information. We take in something like 11 million bits of information per second through our eyes. However we only have a capacity for dealing with something like 134 of those bits. So we lose a tremendous amount of information through our filters.

Our filters are run in conjunction with our subconscious, they determine our experience and our perception of events and experiences.

The filters that we have are based upon our past memories, decisions, and beliefs. If we experience something related to a past belief then our subconscious automatically assumes that belief for us, it does not ask us to make that decision again. We chose to have that belief in the past and we will only reassess that belief if we consciously make a decision to do that. Otherwise the brain will assume the belief to be true.

So what we experience in our current awareness is clouded somewhat by our past beliefs and decisions.

This is really important to be aware of in trading because as individuals we make decisions to trade based on the information in our awareness, not necessarily based on the reality of the situation in the markets. We make decisions to trade based on what we believe to be true rather than what is fact.

This is one reason why computers are so effective in trading, because they don’t have the same problem with clouded reality, they make decisions based only on the algorithms and the reality itself of price action.

Emotions in trading

Where do emotions in trading fit in to all of this?

Emotions are generated in the subconscious part of the brain. They are actually really important for our survival. The emotion of fear is designed to warn us of imminent danger. We see a threat, we get scared. We either fight or run. Flight or fight. This is an automatic response. If think that we can win then we stand and fight. If we think that we might get eaten then we run!

The subconscious cannot distinguish between real and imagined danger. It relies on our conscious brain for instruction.

If we are in a losing trade and we fix our eyes on our current profit and loss position. Then we may feel fear. Fear of losing hard earned money. This will automatically provoke our fight or flight response. What is the flight response in trading? We exit our trade for a loss. The thing is that this reaction has happened automatically. It may not necessarily have been what our trading system would have wanted us to do.

If we decide to stand and “fight” then we may end up running our losses for far longer than we would have normally liked to. We sit there defiantly hoping that the market will turn around. Eventually the fight leaves us and we give up. We exit the trade for a much bigger loss than we should have had.

Bear in mind again that the brain has a limited capacity for processing information. If we are feeling lots of emotion then we are blocking access to conscious thought processes. The body and brain sense that the emotions are more important than rational thought at that time. We must stand and fight or run, it is a question of survival!

This is why all rational thought leaves us when we are losing in our trading. We end up in tunnel vision, taking trades that we shouldn’t do. This is the fight function. We keep on trading and trading until we eventually get a moment of lucidity and we realise what we have done. By then it is too late. We have blown a hole in our trading account.

It is easy to think that the solution to this is to buy access to a trading algorithm or system that trades for us. This is not taking responsibility however. This is being at effect. And those traders who have lost fortunes using automatic trading systems will tell us that this is their biggest mistake.

The way to handle all of this is to have coping mechanisms built into our body and brain. These act as pressure release valves for our emotions.

We need to train our subconscious processes to react the way that supports us best in our trading. Train ourselves so that we trade based logical thought processes, so that we look at price action in the markets objectively, so that we recognise fear when we feel it and we deal with it.

We do this through a process of improved self awareness. Which is what we are doing now. And through a process of visual and mental rehearsal which is what we are going to go on to do in this programme.

This is how we master the emotional and psychological side of trading.