Over the next few weeks I am going to illustrate a specific method which will show you how to trade the EUR/USD forex market on the 5 minute timeframe.

My aim for this trading series is to enable you to gain an understanding of how to execute a rules based trading plan with the objective of growing a small trading account over a short period of time.

I am going to lay out below the type of trades that we will be taking and reviewing each day. The type of trades that we will be discussing occur on a regular basis on the EUR/USD and once you get to know the rules, the entry and exit strategies, you will have a set of criteria that you can use in identifying these same trading opportunities for yourself.

It will be useful for you to have some basic knowledge of trading in order to get the best from the articles. However we will be gradually building your knowledge and skills in terms of this particular approach to trading and the EUR/USD forex pair in particular.

The framework for these trades is common to most of the major forex pairs and in my experience the trades appear most frequently and the approach works best with the EUR/USD pair.

My recommendation to you would be initially to get to know these trades inside and out by following this series. Get to know what type of things to look out for that give the trades a higher and lower probability of success. Once you get a feel for the type of trades and opportunities that we are discussing you may then like to go to your charts each day before referring to our articles and start picking out the trades for yourself. You can then validate what you identify from your charts by reading our review of the same price action.

No specific advice or recommendation to trade is intended through these articles. As always, you trade at your own risk.

This is one of several types of trading strategies that I employ myself and that I teach traders on our Forex Trading and Day Trading Courses. This is a day trading strategy and is based on reading price action on the 5 minute timeframe charts.

On our courses we teach you how to trade from the ground upwards. We enable you to build your own trading plan based on the type of trading that suits your personality, risk tolerance and the time that you have available to trade.

Let’s get into some detail now on the types of trades that we will be taking.

The type of EUR/USD forex trades that we will be reviewing and our rules

In this series we will be focussing on two particular type of trades.

- Breakout trades from tight consolidation ranges.

- Pullback reversal trades

We will be using technical analysis of the price action on the 5 minute timeframe chart in order to find our trade entries.

We will largely be ignoring any fundamental analysis although we will be regularly reviewing the daily timeframe chart to enable us to get an overview of longer term trends, support and resistance levels and momentum.

We will be taking long and short trades.

Technical Trading Indicators – We will only be using the 8, 20 and 90 EMAs (Exponential Moving Averages).

Risk and Reward on our Trades

One of the keys to growing small trading accounts and trading successfully is managing risk.

We will be taking trades with a 2:1 reward to risk ratio. This type of ratio allows us to have a very conservative win rate on our trades and still make money.

A win percentage of 70% is certainly achievable for these type of trades with experience and skill buildup over time. However, it is always sensible to be cautious with expectations in trading and therefore with this type of risk to reward ratio it allows us room to take as many losing trades as winning trades and still grow our account rapidly over a fairly short period of time.

Breakout Trades from tight consolidation ranges

The EUR/USD forex market tends to have periods of quite low volatility followed by a big surge in momentum. We will be aiming to identify breakout trades from ranges created by these periods of low volatility and trades that take advantage of the resulting surges of momentum.

Frequently, as we will see, the overnight trading volume is low on this forex pair. The market assumes a tight trading range during the early hours of the morning. A breakout will eventually occur from this trading range and with the right type of price action we will often see the market zoom off in one direction or the other. These are the type of breakout opportunities we will be trading.

Pullback Reversal Trades

After the market has made an initial surge upwards or downwards it often takes a pause before continuing in the direction of the initial surge. We will be anticipating this continuation by taking clues from the price action in the candlesticks, the degree of pullback that occurs and the way that the price candlesticks interact with the EMAs.

How to trade the EUR/USD using the 5 minute timeframe chart

Example trades

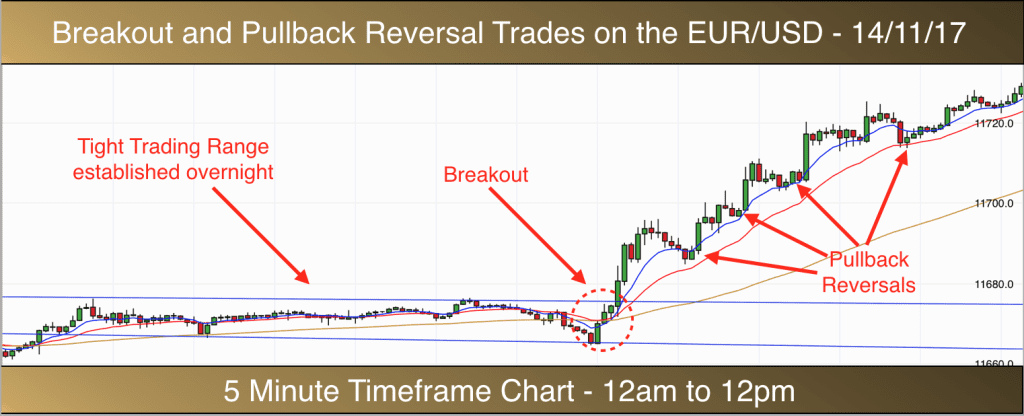

Here are two charts from last week that illustrate the types of trades that we will be looking for:

This is the EUR/USD 5 minute chart from the 14th November.

You can see the tight trading range that was established overnight, the breakout from the range, the subsequent momentum move higher, the pullbacks and the reversals.

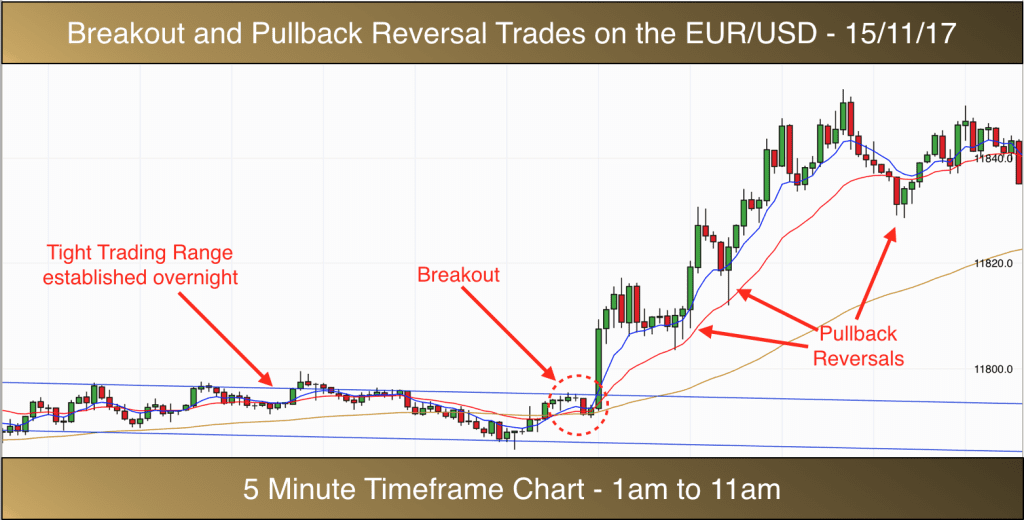

Below is the EUR/USD 5 minute timeframe chart from the 15th of November showing the same type of price action:

I look forward to sharing this trading strategy with you, giving you valuable incites into how to trade the EUR/USD and how to grow a small trading account.

If you have any questions or comments then I would be pleased to hear from you. Feel free to leave me your thoughts in the comment box below the articles.