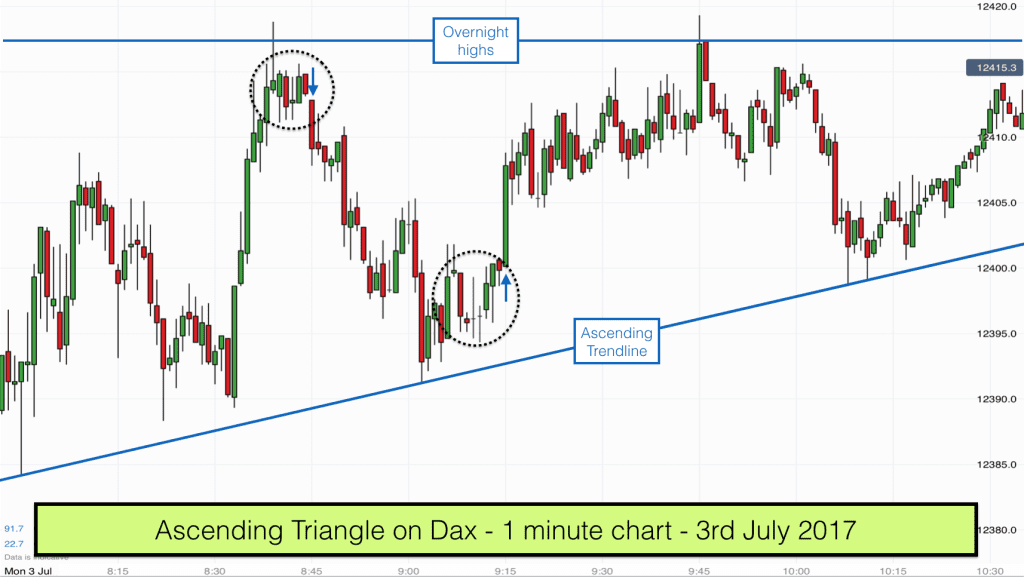

Ascending Triangle on DAX – 3rd July 2017

This Ascending Triangle appeared from a quiet morning of trading on the DAX. I don’t normally trade all day but I do like to look out for early morning trading opportunities and after a big down week on the DAX last week I was waiting with anticipation to see what the markets would offer this […]

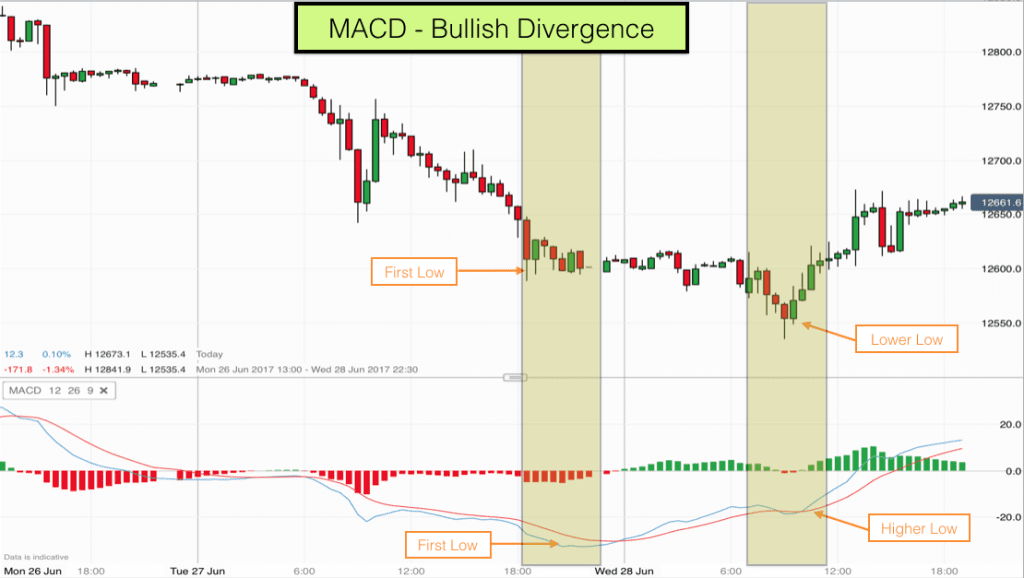

MACD Bullish and Bearish Divergence with Price

MACD bullish and bearish divergence with price is one of the factors that traders use to judge the end of a trend or strong directional move. Usually some kind of tradable reversal takes place after a bullish or bearish divergence between the MACD indicator and price. We will look at a couple of examples from […]

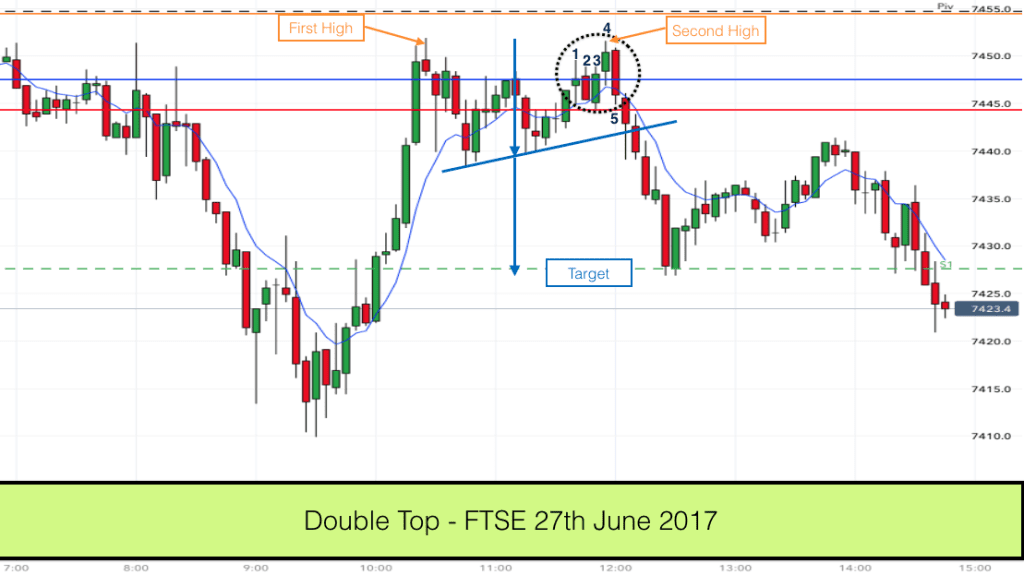

Double Top (variant) on FTSE – 27th June 2017

This double top variant appeared today on the FTSE just before lunchtime. I say double top variant because it could also be described as a Head & Shoulders top if it weren’t for the fact that the head was lower than the shoulders. It’s an unusual pattern but it traded just perfectly. The chart above […]

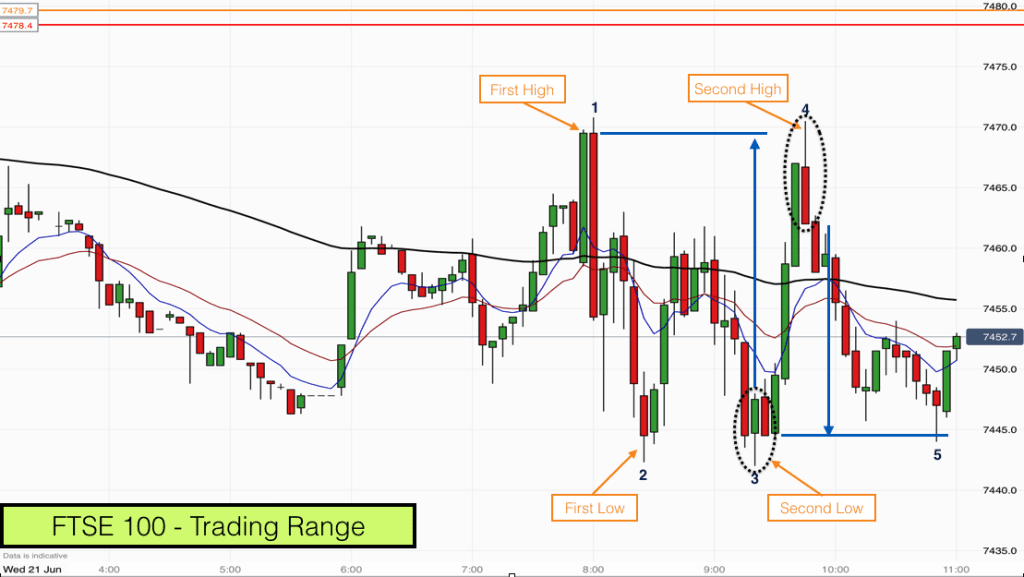

How to identify and trade trading ranges | FTSE 100

Markets spend 70% of the time at least in trading ranges so learning how to identify and trade trading ranges is vital for any aspiring trader. We are going to take a look at a textbook trading range from todays action on the FTSE 100 index to help you identify a trading range and profit […]

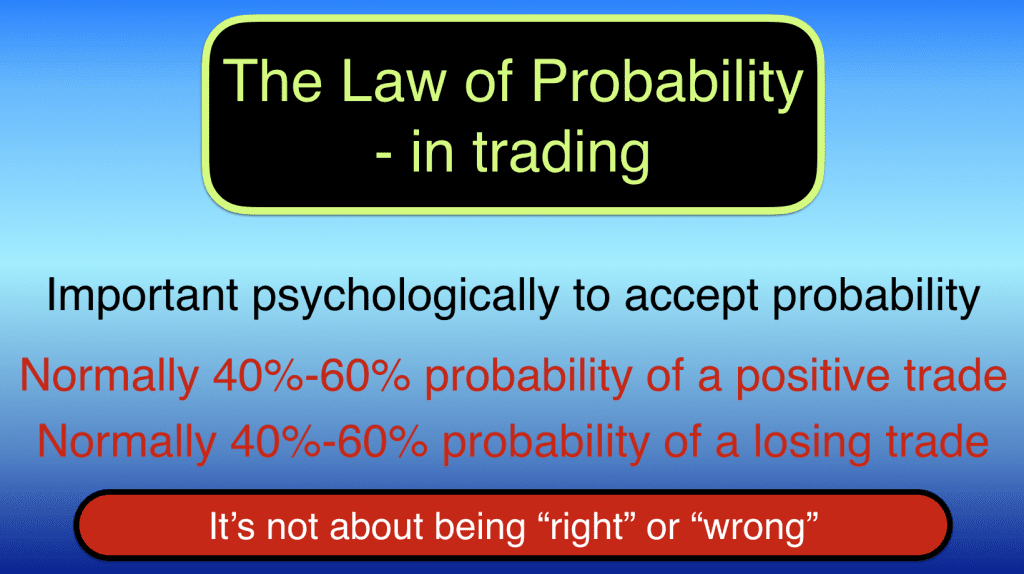

The law of probability in trading – Trading Secrets

In this part 7 of our Trading Secrets series we are going to discuss the law of probability in trading. Most traders are familiar with considering risk and reward as part of their trading system and indeed these aspects are very important, however just as important is the likelihood of a trade being successful, i.e. […]

How to trade a low volatility market

How to trade a low volatility market. There are some days and periods of time when there is reduced volatility in the markets. Yesterday was one of these times since it was a public holiday in the UK and US. The main markets tend to close during public holidays however the 24 hour markets are […]

Trading Secrets – Beware of market manipulation

I hope that you have already found this series useful and are beginning to understand yourself better in terms of how to build a successful trading future with the right mindset and some tools for mastering the emotional and psychological side of trading. We have discussed how beliefs are important in trading and how […]

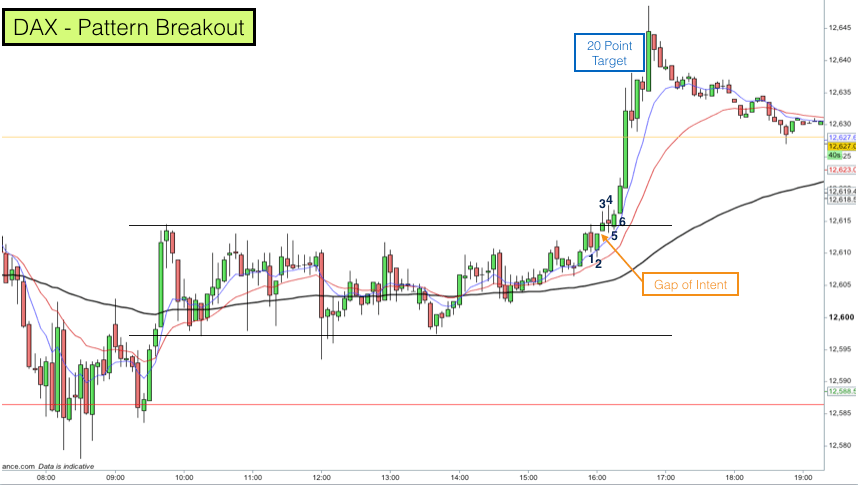

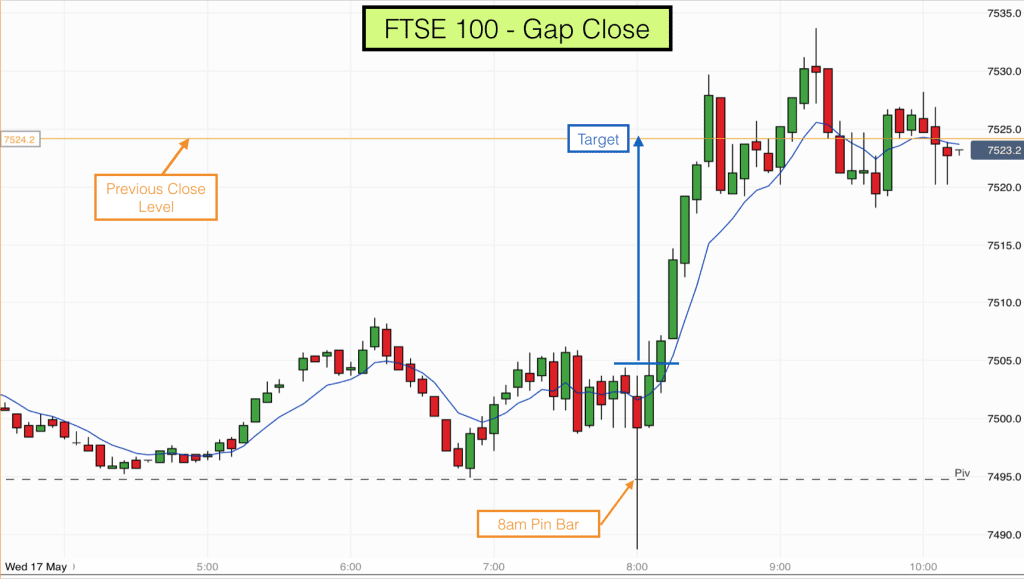

Day Trading FTSE & DAX 5 minute chart 17th May

We have three day trades to review for you from this morning. One trade was a gap close on the FTSE 100 and the other two trades were on the DAX. These type of chart patterns occur regularly on the FSTE and the DAX indices. Our aim for reviewing these trades for you is so […]

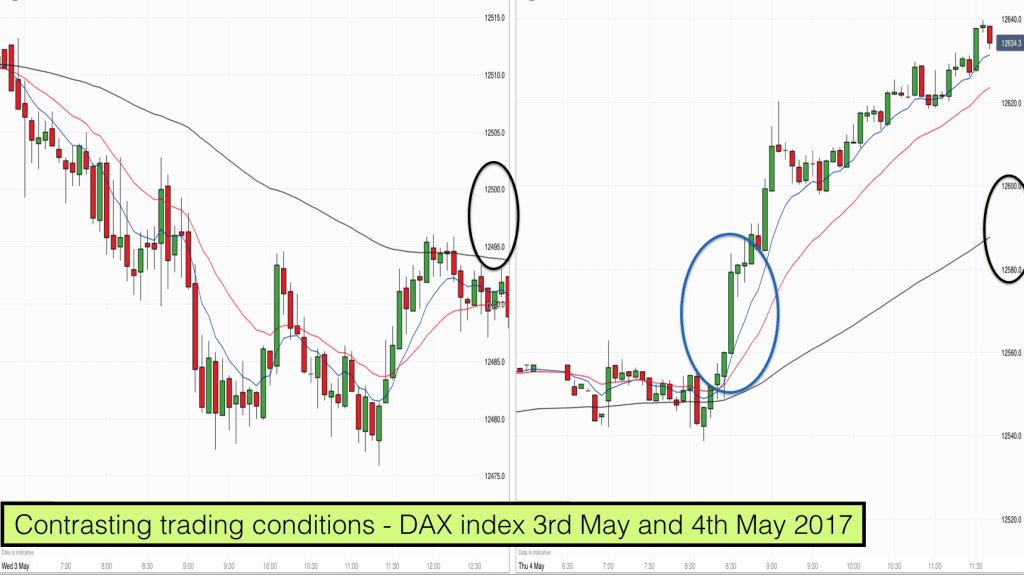

Trading different market conditions – DAX index 3rd and 4th May

Two mornings and two very different trading conditions on the DAX index over the last two days. Have a look at the charts above. On the face of it you might just see one chart on the left where the market is going down and another chart on the right where the market is going […]

Supercharge your stock trading by recognising and identifying beliefs

In this part five of our Trading Secrets series we look at how to supercharge your trading by recognising and identifying beliefs. Beliefs are important in stock and financial trading. One of the best edges that we can have over our competition is to understand when market action is creating beliefs amongst other traders that […]