In this part 7 of our Trading Secrets series we are going to discuss the law of probability in trading.

Most traders are familiar with considering risk and reward as part of their trading system and indeed these aspects are very important, however just as important is the likelihood of a trade being successful, i.e. Probability of a successful trade given market conditions. This is the vital third part of a successful traders equation.

Science has proven that the mind plays funny games with us in terms of assessing probability of successful trades. Prior to placing a trade we tend to be more objective in terms of the likelihood of winning. Once committed to a trade our mind tricks us into believing that we have a better probability of winning than is in fact reality.

This can be the cause of big losing trades and losing streaks and is otherwise known as confirmation bias in trading circles.

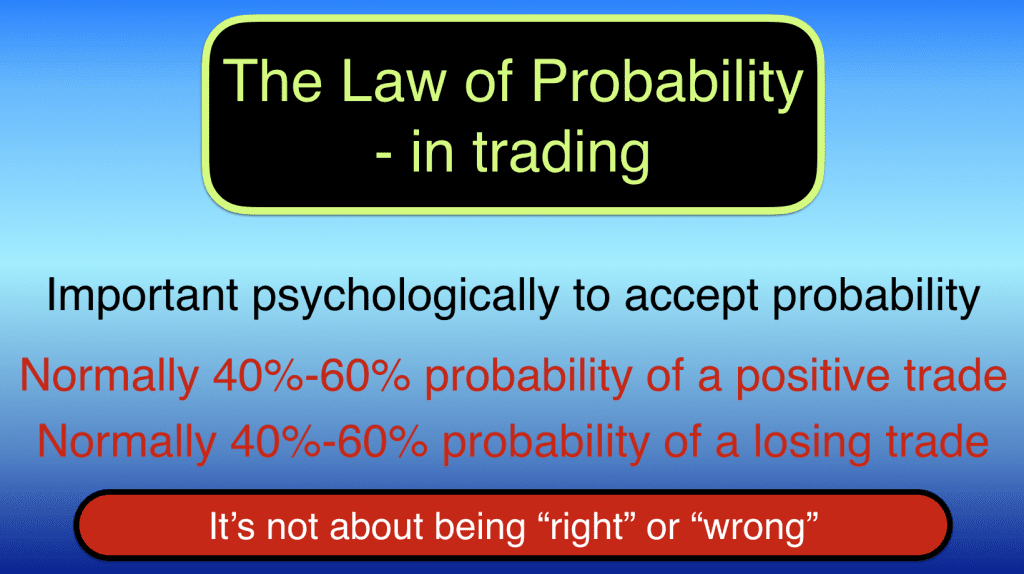

The law of probability in trading

When we believe things we assume them to be 100% true until proved otherwise. This isn’t how trading works. In trading the probability of a successful trade is normally between 40%-60%. It depends on different market conditions and timing or trades.

We can be successful with 40% of our trades and make lots of money as long as we manage them correctly.

We can take successful trades 80% of the time and still lose money if we manage our trades poorly.

In fact anyone can trade in either direction and make money 90% of the time as long as they manage their trades well. However this can be very difficult to do, especially from an emotional point of view.

We therefore need to assume that at any one point in time we have a probability of 40%-60% with any of our trades depending on the market conditions. This means that we will also be unsuccessful 40%-60% of the time.

We need to have the knowledge to assess the market and judge the probability of success of each potential trade. Is it 40%, 50% or 60%? It is never 100%.

As I have said before. We like being right. We hate being wrong. So losing on 50% of our trades will seem like failure to us as long as being “right” is what we associate with successful trades and being “wrong” is what we associate with losing trades.

Our brains are wired to tell us that if we keep getting things wrong we are “no good”. We develop limiting beliefs as a result of being “wrong”. We start thinking that we “can’t do it.”

An educated and objective belief in trading has a 40%-60% chance of turning into a successful tradable opportunity if we learn to ignore the false signals that the market presents. By successful tradable opportunity I mean one that will produce a good reward to risk.

Anyone can take a risk of many times the potential reward and be “right” 80% of the time. However they will not be profitable.

Is it more important to you to be profitable than right?

It should be.

The good news is that we can be right 100% of the time as well as being profitable. Being “right” in trading means taking trades according to our system. The system itself should take care of the probability and reward v risk aspects of trading.

Our system should also take care of our beliefs. It doesn’t matter what we are seeing on our charts. If something happens and our system says trade then we take the trade. If we are not profitable over time and we are trading our system perfectly then we need a new system!

If we see something on our charts and we think “it looks like it is going…” but it doesn’t trigger a trade based on our system then we don’t take the trade.

When we take a trade with our system then we accept that it may be a losing trade. It has a certain percentage chance of being a loser. If we lose then this doesn’t mean that we were wrong. It is just the probability of the trade. Take ten of the same trades and if we have followed our system and the system works then we will be profitable.

This is how you deal with losing trades. This is how you deal with beliefs in trading. Have a good system and stick to it.

Exercise

Here is another exercise for you to do. If you have got your trading system written down then go and get it. If you haven’t got a system written down then stop right now and write it down.

Once you have it then I want you to examine it and scrutinise it for beliefs. What beliefs are there in the system. Are they facts or are they beliefs? Could they be wrong? Are they supportive or unsupportive?

Write down what you discover.

Sometimes experienced and profitable traders never do this exercise. They create a system when they are beginners and this system is designed specifically for them based on their current experience. When they get more experienced they work the same system, based on the same beliefs that they had about themselves and about the market as they had as beginner traders. If they were to examine their system and adapt it to changing knowledge and experience they could exponentially improve their profitability.

Do you have some beliefs that you would like to change? That’s what we are going to do in the upcoming sections of this series.

If you are still looking for a trading system to take you into profitability then take our online trading courses. As well as teaching you how to spot trading opportunities and read the market we will provide you with custom designed trading systems that you can use in the markets right away.