How to trade a low volatility market. There are some days and periods of time when there is reduced volatility in the markets. Yesterday was one of these times since it was a public holiday in the UK and US. The main markets tend to close during public holidays however the 24 hour markets are sometimes open as they were yesterday. When markets are open there is opportunity so lets take a look at the breakout trade that the DAX offered yesterday as an example.

When considering how to trade low volatility markets the fundamentals remain the same. We are looking for good risk to reward opportunities in the right context and with good signal candlestick patterns.

Context is created by price levels and the way in which price has reacted to these levels in the past. We are talking about support and resistance levels here. Support and resistance levels create breakout opportunities, in turn breakouts create good risk and reward trading opportunities with excellent probability.

Sometimes in low volatility markets nothing happens all day. Price can just fluctuate around a level and stay there. This can be frustrating for a trader and I recommend trading sparingly in low volatility markets as a result.

The best time of day for trading in low volatility markets is around the time of market open and close. In the UK this means 8am-10am and 2.30pm-4.30pm. The US markets open at 2.30pm UK time and this tends to bring in the greatest number of traders to the market.

Breakout trade in a low volatility market on the DAX

My favourite indices to trade is the DAX. The reason? The DAX has the highest level of volatility of the main European indices combined with the lowest commissions for trading it.

It is rare for a day to go by without a trading opportunity on the DAX, even on low volatility trading days.

Yesterday we did get a good trade and we had to wait until 4pm for it to materialise.

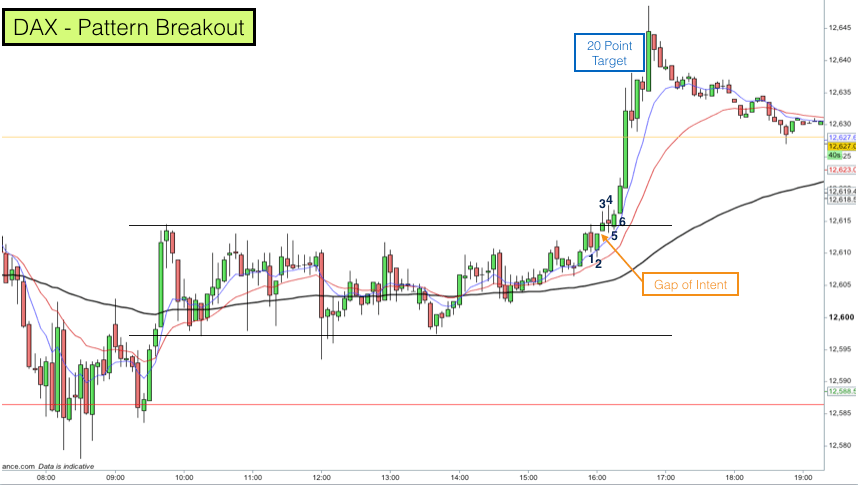

Take a look at the chart above. It show the DAX price candlesticks on the 5 minute timeframe for the 29th of May 2017.

The first thing to note is that the market entered a trading range at 10am and didn’t breakout of the range until nearly 4pm. We were able to draw two pattern lines (black horizontal lines) on the chart to encompass price action during this trading range period.

Trading Range Breakouts

The key to trading the trading range breakouts is patience. I tend not to sit all day and wait for breakouts. I set my system alarms to go off when price reaches the high and low of the range. When the alarm goes off I take a quick look at the price action leading up to price reaching the outside of the range and decide if I am interested.

I am looking for price buildup around the high and low of a trading range. Price tends not to dash right from the top of a trading range to the bottom and then breakout. Likewise it doesn’t dash from the bottom to the top and then breakout.

What tends to happen is the price will hover around the top of the range before breaking out higher and hover around the bottom of the range before breaking out lower – this is what I mean by buildup.

There is a key ingredient to buildup and that is double pressure. Double pressure exists when the market feigns to go one way before heading off in the other direction. The double pressure is when both bulls and bears are buying or selling at the same time. One side is buying or selling for profit and the other to get out of losing positions.

My alert went off yesterday at just before 4pm when bar 1 on the chart above hit the upper pattern line.

You will note that bar 1 was a bearish candlestick. This is quite normal as there are always lots of traders trading the fade down from the top of the trading range. However you will also note that bar 1 had rejection at the bottom as well as the top of the candlestick. It was a trading range bar and the rejection at the bottom of the bar was significant as it created the double pressure scenario. Bears entering on the close of bar 1 and at the low of bar 2 were caught in a trap.

When bar 2 made its way back to the top of the range and closed on its high the breakout was a possibility. At this stage you will note that all three EMAs (8,20,90) were pointing up and price was being pushed up by the 8 EMA. This is a great sign for a breakout.

Bar 3 opened higher than the close of bar 2. This created a small gap on the chart, I call them gaps of intent. Gaps are often a sign of strength and the market was showing signs of bullish intent with this gap.

Bar 3 made its way outside of the range. Price reacted to leaving the range by testing the range border from above. This was resistance becoming support. Bar 4 was another range bar, rejection at the top and bottom.

Bar 5 was an inside bar. The high and low of bar 5 was inside the high and low of bar 4. This is excellent buildup and again it produced a double pressure event. Bears entering at the low of bar 4 were trapped. Bulls were looking eagerly now for the breakout higher.

Trade risk and reward

The breakout came as bar 6 took out the high of bar 4 (the highest bar in the buildup series). This triggered me into a long breakout position. My stop was below the low of bar 2 (the lowest low in the series). This gave me a 9 point risk. More than acceptable for breakout trades. On the DAX market I tend to look for 20 point moves after a breakout.

You can see that the double pressure event created huge momentum upwards. All the bears were sent scuttling for cover and the bulls entered with vigour.

We got our 20 point target within 6 bars or 30 minutes.

If you are learning to trade then take one of our trading courses to learn with us how to spot opportunities like the breakout trade that we had today, how to manage your trades, and how to trade with a good traders equation.