Markets spend 70% of the time at least in trading ranges so learning how to identify and trade trading ranges is vital for any aspiring trader. We are going to take a look at a textbook trading range from todays action on the FTSE 100 index to help you identify a trading range and profit from trading in trading ranges in the future.

As always with these posts I will explain how I identified the context and the signal for the trades that I took this morning. It is a process of consistent reinforcement of information for traders. Trading isn’t easy but certain patterns repeat themselves again and again in the markets and the key to successful trading is to see the opportunities when they arise and take the trades according to a positive mathematical equation.

Trading Range on the FTSE 100

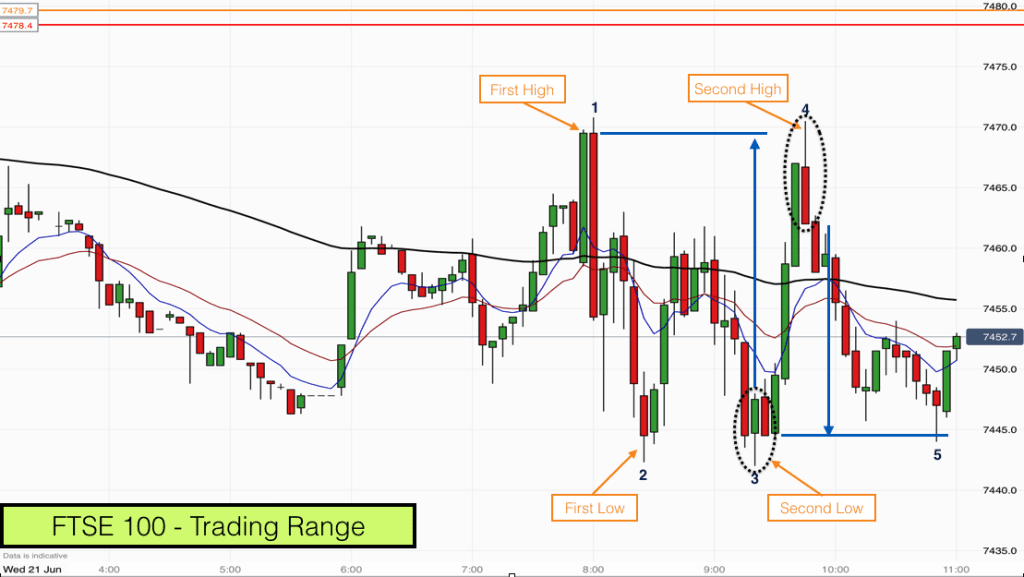

In the chart above you can see the price action on the FTSE 100 from this morning. Normally I trade the FTSE, DAX and Forex markets for about 3 hours per day during the morning session (most volatile session). I can usually find a couple of good risk and reward trades during this time. Todays trades were buying from the bottom and selling from the top of a trading range.

When I first started trading I hated trading ranges. The main reason is that in trading ranges nothing is clear. Price always looks like it will breakout higher or lower before doing the opposite. This used to be confusing for me until I realised that confusion is exactly what trading ranges are all about. When things are not clear and the market has a period trading which is directionless then the chances are that it is in a trading range.

The kind of thing that characterises trading ranges is alternating candlesticks. Red, green, red, green, red, green. There are usually also lots of candlesticks with pins on the end of them.

In trading ranges markets are consolidating. They can appear at the end of a trend and be followed by either a trend reversal or trend continuation.

Professional traders who work for the big banks know that markets spend far more time in trading ranges than they do in trends and they have specific plays for trading in trading ranges. This is important to recognise because for home based traders to be profitable we need to discover the actions and intentions of the big institutions and copy them. We cannot move the market with our money. The institutions move the market.

When the institutions are buying, we need to only take buy trades. When the institutions are selling, we need to only take sell trades.

Identifying the range of a trading range

Take a look again at the chart above. On the open this morning the market made a high with bar 1 (labelled 1 on the chart). It then made a low with bar 2 several candlesticks later.

After bar 1 and 2 had been and gone we had our range. Notice that bar 2 also had a low at a similar level to the pre-market lows. This provided further confirmation.

We now have two levels. A high and a low. We then play a waiting game to see what happens next time the price action visits these levels.

Trade 1 in the FTSE 100 trading range- Buy from the lows

Bar 3 opened at the same low as the close of bar 2. It attempted (and succeeded) to make a lower low and price immediately rejected off the lower prices – note the pin on the end of the candlestick.

Bar 3 closed almost on its high and had a bull body with a pin on the lower end. This is a bullish pin bar at the bottom of a trading range. A perfect buy signal.

We wait for bar 3 to close and then enter a long trade as the market breaks the bar 3 high.

Our protective stop is tightly placed just below the low of bar 3. We know that if price goes down here then our trade is wrong, so it makes sense to get out here.

Our target for the trade is the open of the 8am candlestick (bar 1). This is also the high or the trading range. This leaves us with a trade where our risk is about a third of the potential reward, so a perfect trading opportunity.

You will notice that I have three moving averages on my charts. They are basically redundant when the market is in trading ranges. Although you can see that the market is gradually going lower and taking the 90 EMA (black line) along with it.

On this trade we made target within 5 candlesticks on this 5 minute chart.

Trade 2 in the FTSE 100 trading range – Sell from the highs

Bar 4 reached our target for trade 1 above and also resulted in a bearish pin bar at the highs of the range. It had a pin on top and a red bearish body closing on its low. This is another good signal candlestick in a perfect context area.

We enter the trade after the next bar takes out bar 4 low. As per trade 1, our protective stop is above bar 4. Our target is the open of bar 3. This trade had an acceptable risk to reward and this time it was about 1:1.5. Not quite as good as in trade 1 as the signal bar was larger, however the probability was excellent.

This time it took about an hour to reach target with bar 5.

The message from these two trades is simple. When in trading ranges buy low and sell high. Wait for good entry signals and pay attention to previous price action to gain the context.

I hope that you found this useful. In our online trading training course we help beginners learn how to trade and read market price action so that you can take advantage of these type of scenarios. I’d be delighted for you to join us inside your course.