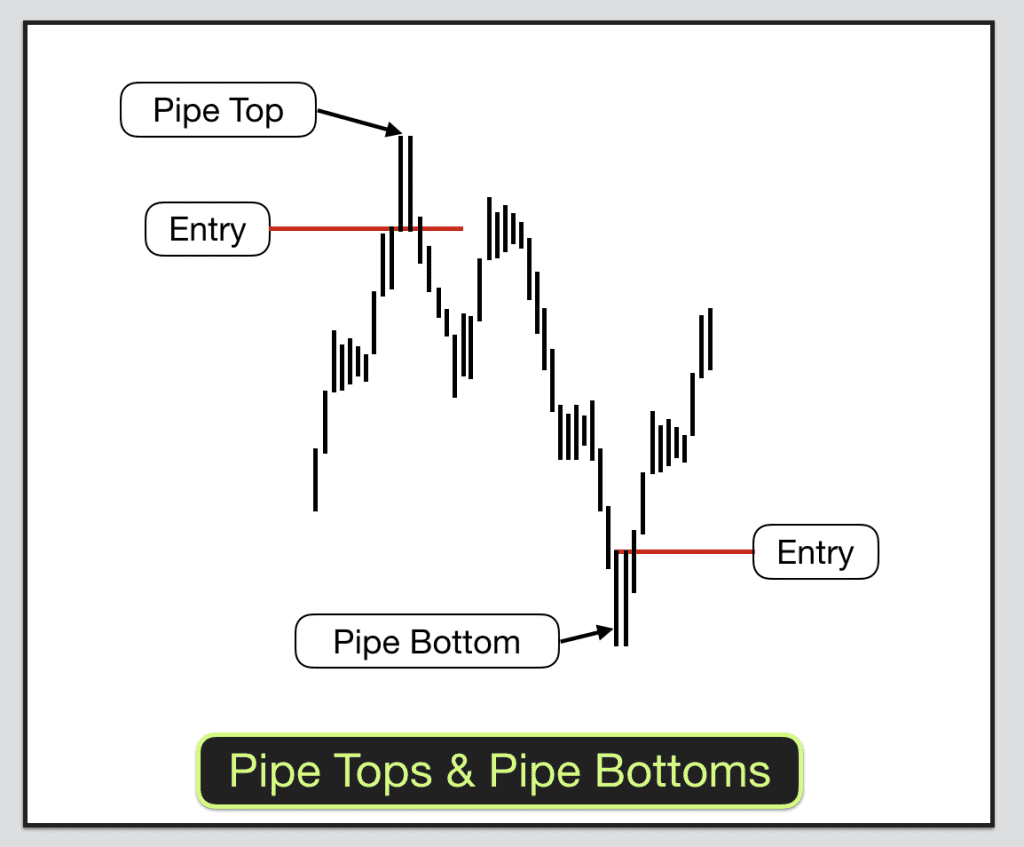

Pipe tops and Pipe Bottoms are otherwise referred to as horn tops and bottoms or two bar reversals. These are two adjacent price bars or candlesticks sticking out of the tops and bottoms of price swings.

How to identify the chart pattern Pipe Tops and Pipe Bottoms

These are quite common chart patterns and especially so in weekly charts.

In terms of candlesticks, one of the candles will be green and the other one red. At tops you will get a green and then a red candle sitting adjacent to each other, one bullish bar followed by a bearish bar. At bottoms you will get a red then a green candle alongside, bearish followed by bullish.

These price bars tend to be longer than average and at least as long as the last five bars.

The second bar will ideally be an engulfing candlestick or a piercing candlestick. They will form two parallel lines.

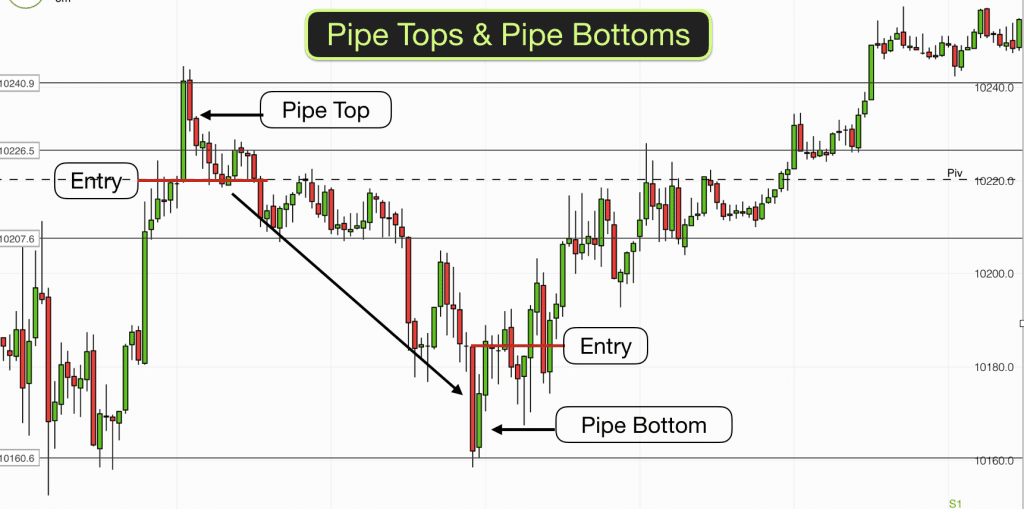

The first of the two candlesticks is in the direction of the previous trend and often pierces a support or resistance level. The second of the two candlesticks reverses the price action of previous candle immediately thus rejecting the breakout from the support and resistance level. Thus the two bars stick out of the tops and bottoms of moves like a pipe.

How to trade Pipe Tops and Pipe Bottoms

A Pipe Top is confirmed when price closes below the pattern low. Price will often fall to the low prior to the Pipe Top before stalling or reversing.

A Pipe Bottom is confirmed when price closes above the pattern high. Price will often rise to the high prior to the Pipe Top before stalling or reversing.

Pipes that are preceded by large, quick moves often work best, as there is less support or resistance in the way on the move back.

As a rule of thumb the longer the price bars in a pipe the better the likely result of the trade, this makes sense because the second bar in the pipe represents serious rejection of the previous move.

If price closes below the low of the pipe then exit your position. You need to position your stop to allow some room for price to bounce off the bottom if it chooses to do so.

Exit for profit at the nearest support or resistance level.