Day trading using my own algorithm and automatic system – Week 3

Having been trading successfully for several years I spent several months designing a trading algorithm that would replicate the type of trades that I have been used to taking manually. Having come up with something approaching what I was looking for I backtested the system again and again. I put the system to work successfully in a demo trading account for several weeks and I am entering week 3 of trading using the system in a live trading account with REAL money.

The system is trading the 1 minute timeframe on the DAX.

Week 1 was a small losing week (the equivalent of 50 points) but I was generally happy with the way that the system worked. At the end of the week I made some small amendments to the algorithm in order to reduce the effect of charges and reduce the number of trades that it took. Week 2 was hugely successful and profitable, I was up 180 points. So, the system currently stands at an overall profit 130 points.

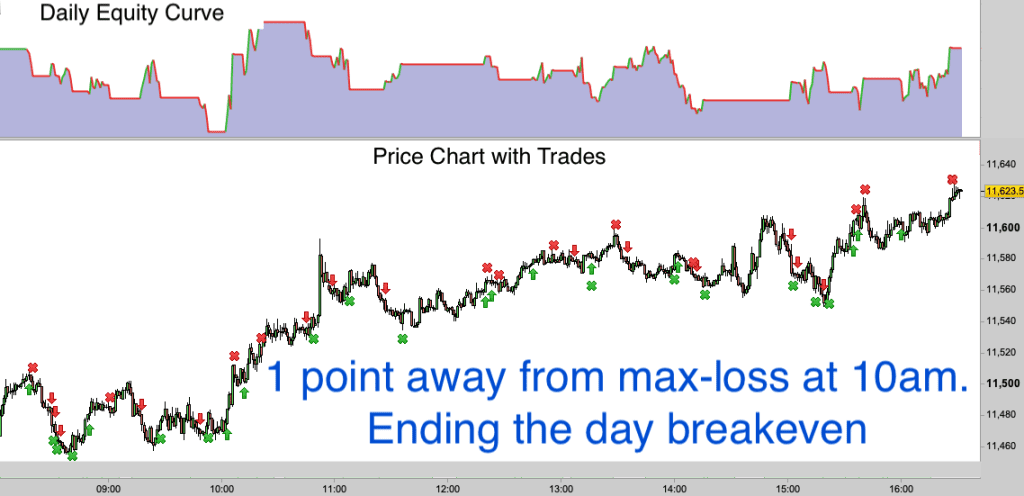

Monday 15th October 2018

I was incredibly lucky not to stop out with a max-loss of >37 points today. You can see from the chart above that the market got stuck in a tight range in early trading (a squeeze – you can see a converging triangle in the price bars from 8am to 10am if you look closely). I got trapped several times by false breakouts and took losses on those trades. At 10am I was just one point away from stopping out for the day with a loss.

In a way I got lucky, because one point is neither here nor there. In fact the price action was very jerky today and many of my trades suffered slippage as the market faked breakouts, stopping me in to trades at a poor price, only to reverse on the next bar and go in the other direction. We get days and periods like this some times especially after a big directional move from the market like we got with the stock market sell-off last week. The market re-establishes an equilibrium between buyers and sellers, this is causes the false breakouts. It is a pause in the market and we get tight price bars gathered together on the longer term chart.

In another way my system did its job perfectly. I set the max-profit and max-loss levels for the system based on statistical analysis of past performance and I set them at specific levels which has proved most effective and profitable in the past. I did not choose to set the daily stop loss at one point less than it is set because that proved less effective.

Anyway, after the market broke out of the early squeeze trading became a little easier as the market wound its way steadily higher and the system was able to take advantage of several opportunities going long on the breakouts higher.

Within half an hour of nearly stopping out we were back at breakeven and even entered green territory for a while before basically treading water in the red all afternoon. The final trade of the day at 4pm looked for most of the time like it would be a loser but as the market approached the close at 4.30pm it decided to breakout higher once again and took me just into the green. I ended the day green by half a point!

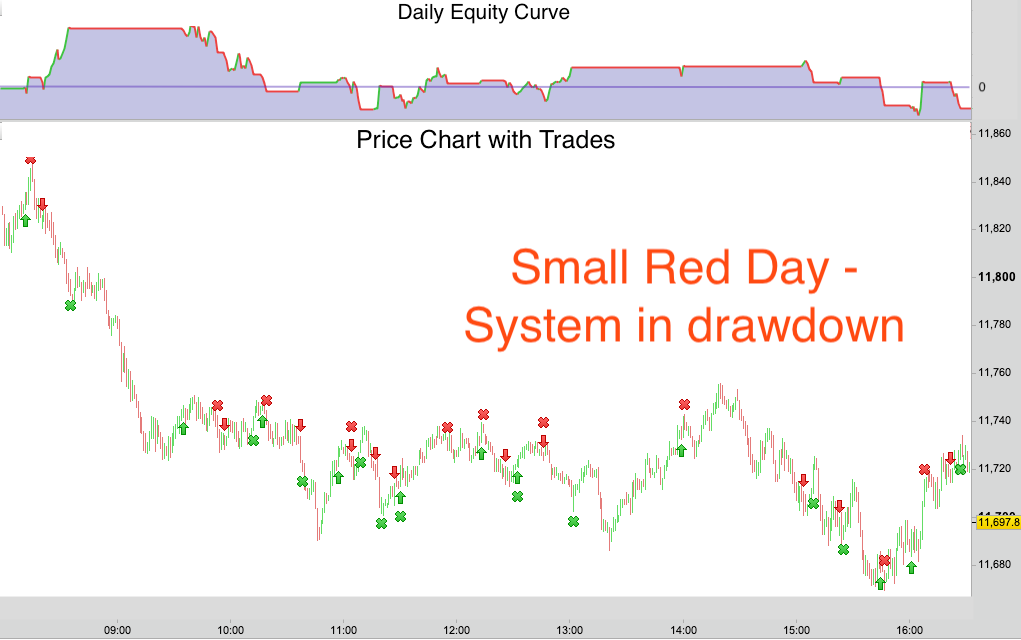

Tuesday 16th October 2018

The system only took 4 trades today. Each of them was a loser and it took me to max-loss, 37 points down. That’s me done for the day.

It is always a temptation on days like this to keep on trading, try to make the money back. After all being finished with a loss at 9.30am leaves nearly a whole day of trading ahead. However this is not the way to trade profitably. I have learned over time that on days like this if I keep on trading then some days I will finish positive and on others the losses just get worse. The way to be profitable over time is to have a cut-off point and when you hit that point then just down tools for the rest of the day. This is exactly what my system does.

When I first started trading I hated sitting all day on a loss. It used to play on my mind all day and I got drawn into taking more trades later in the day. This is how beginners end up having what we call “snowball” days, massive losses which are hard to recover from. Now every day is the same to me. Win or lose. Over time the wins stack up and as long as winning days are bigger than losing days, then everything is fine.

As per yesterday the market remains in a period of low volatility. It is in a trading range and the early morning trading was filled with false breakouts, or fakeouts as we call them. This type of market condition can persist for some time but usually it works its way out of the market over a couple of days and the market then becomes more directional for a while.

Overall my automated system still stands me at a profit of 90+ points. I will turn my attention to other things for the rest of the day and hope for more positive trading conditions tomorrow.

Wednesday 17th October 2018

The system is currently going through a drawdown period as the market adjusts to the big falls of last week with a series of tight trading ranges. It has been a week since the last good winning day for my system. Today we were sitting at breakeven with 10 minutes to go and the last trade of the day was stopped out for a quick loss, leaving me down 11 points on the day. No big deal in the scheme of things.

Up to Thursday last week my system was returning a win rate over an 8 day period of 60% and there had only been one small losing day over that period. This is way above average. I would expect a long term win rate of 53%-55% with one in three days being red and two in three days being green. We were due a drawdown period and here it is!

Today we made a good start. You can see from the chart that the market made a high just after the open at 8am and then surged downwards for nearly an hour. The first two trades of the day took me 32 points up on the day. It all looked rosy in the garden. However we then entered a long trading range, tight price action. The market moved basically nowhere for the rest of the day.

The system coped ok with the trading range but suffered from a few false breaks higher. We got stopped out a number of times betting on a break of the range. These stop-outs took us back to breakeven and then as the market finally started to move later in the day we got unlucky with the final trade which went short as the market signalled a possible reversal. Another false break left me negative for the day.

I have designed the system to cope with drawdown periods by keeping losing days small and the system will pick up gains again as soon as the market conditions allow.

We remain positive by about 80 points in total.

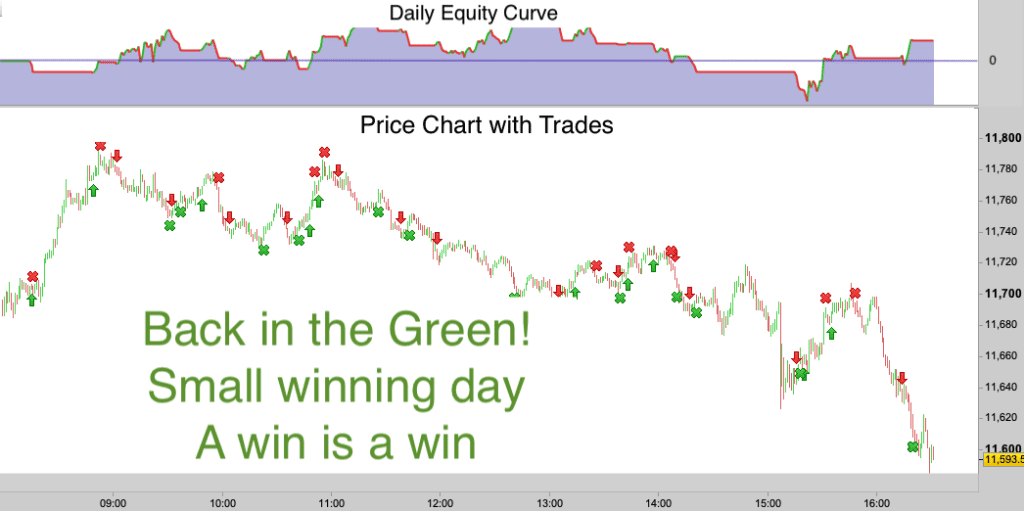

Thursday 18th October 2018

The end of the drawdown period? I had a winning day today with my algo trading system. It was small, I finished up just 16 points but it was a green day and it made back the small losses from yesterday and some. More important than that it put an end to the run of losing days that I have had this week.

It was a very similar day in trading terms to yesterday. A big breakout in the early morning trading and then choppy directionless trading from 9am right up to 3pm. In the last hour today I had two good wins and unlike yesterday I finished with a winner which took me in to green territory for the day.

On the last two days the system has traded all day long. On both days it managed to get into positive territory in the morning, only to be pegged back by false breaks and a trading range market during the middle part of the day.

When I trade manually I generally quit for the day when the market turns quiet like this after 10am (especially if I am up at that time). With my algo trading system I decided when I started trading with it to just let it do its thing and not to interfere with it. So I just let it continue trading. More often than not it will end the day positive and most winning days are bigger than the losing days. This is the reason that it is profitable.

On a slightly negative note I noticed that for the forth day on the trot I suffered fairly large slippage (a broker charge) on several of the trades during the middle of the day. Also as I was watching the live charts with the ProRealTime software and at the same time watching the same charts on the demo system with the same software and broker, I noticed that the live charts were running 1-2 seconds behind the demo charts. It was like watching an action replay. This is disconcerting, especially when my orders were suffering slippage. I contacted IG (my broker), who as yet haven’t come up with a reason for this. I’ll be keeping an eye on it but this isn’t the first time I have noticed it. It suggests to me that ProRealTime software may be running the demo and live charts on different servers. I don’t mind if this is the case but surely the charts should run accurately and simultaneously!!

Overall a positive day and it is always good to end the day with some green trades. :)

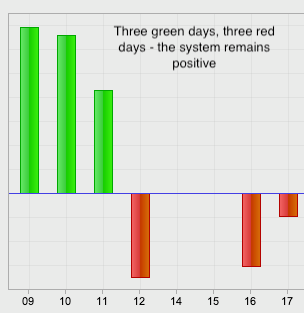

Friday 19th October 2018

This was our third red day of the week and fourth red day out of the last six trading days. I finished down 41 points today. Five consecutive losing trades meant that the system shut down for the day at max-loss level just after 10.30am.

After three weeks of trading the system remains positive by 55 points.

Trading conditions have been unfriendly towards my system all week. They are conditions that I am familiar with and the market does go through phases like this. Essentially the market has been treading water all week. Going nowhere fast. Whilst these conditions are not unusual, they tend not to be persistent and are normally followed by a large directional move like the one that we had at the start of last week. It is during the directional moves upwards or downwards that my system capitalises and makes significant positive ground.

During drawdown phases and choppy market conditions the key for any trader is to make sure that they keep losses to a minimum and preserve capital, this is the reason why I have a daily stop loss. When my losses reach the 40 points level I cease trading for the day. We end the week down but we stay alive and ready to do battle again on Monday next week.

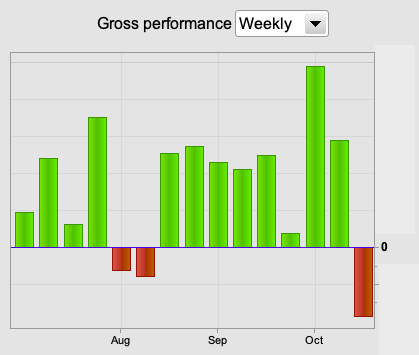

Here are the weekly stats from the backtesting of my system over a period of three months July – October 2018.

Over a three month period – 15 weeks the system has only had three negative weeks – this week being the worst of them. It is important to look at the bigger picture in trading and these stats help cheer me up after a tricky trading week.

The question is, do I change my system to cope with the current choppy market conditions?

One of my systems which is running on a demo account is currently positive for the week and significantly in profit for today. It isn’t that I can’t design a system to cope with market conditions like this but the thing is that over a longer period of time the system that I am trading live is the one that has the greatest profitability. So I shall leave the system as it is for now and go into a new week with positive expectation.

Have a great weekend traders.