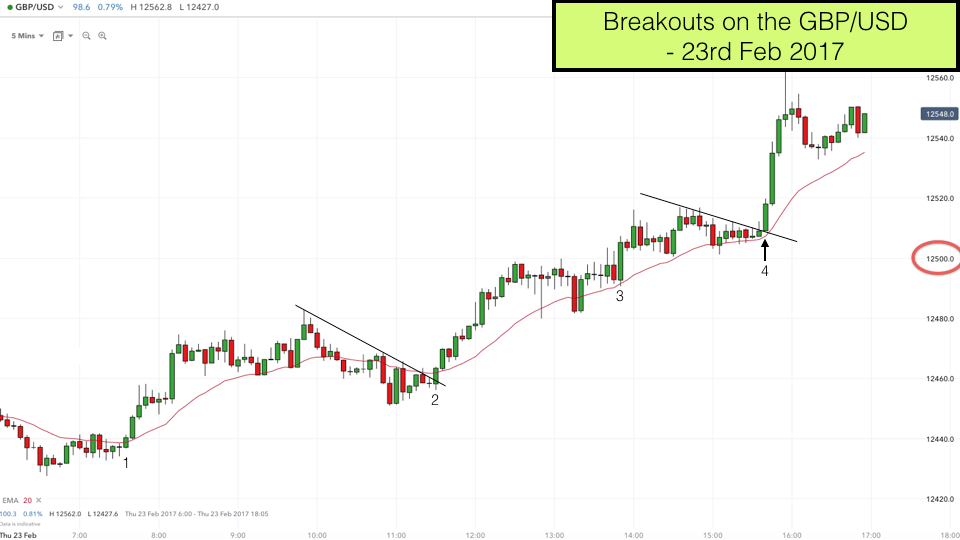

Sometimes the best trades come just as you think that you have missed the boat. The GBP/USD forex pair had been trending upwards all day today. We had three breakouts that just didn’t quite set up for us and I was just about to give it up for the day when we got a fourth breakout that set up perfectly and turned out to be the best breakout of the day.

The four breakouts that you see on the chart 1,2,3,4 all look fairly similar unless we know what we are looking for. I’ll talk you through all four of them so you can see why the fourth one was the only one that qualified as a trade for me.

Breakout 1

This was the first breakout of the day, on the bottom left of the chart. Bar 1 is the potential signal bar and then when the following bar took out the Bar 1 high the breakout started. As you can see it was a great day for momentum traders who held on to their trades from this breakout all day. However for shorter term traders it was a nearly but not quite right set up.

There are some good points to the set up. There is good build up. There is a mini higher low. The preceding candlestick bars had bottoming tails. Price crosses the 20 EMA with a candlestick that closes on its high. There is no ugly block of price action directly on the left to hinder the progress of the trade.

Why is it a skip then?

If we take a look at the price level, the open of the potential entry bar is at 12440. This is just ten points below 12450, which is a round number and a level at which price had peaked in several overnight swings (not shown).

The second reason for a skip is not as strong but important nevertheless, the breakout started from below the 20 EMA. I like my breakouts to start from above the 20 EMA. The reason for this is because price has a tendency to stick to the EMA sometimes and become magnetised to it.

Breakout 2

After the first breakout price peaked at 12480 and then pulled back to the 12450 level. The second breakout of the day followed. This was a miss for me again.

The good points in the set up were that:

- price had pulled back about 50% of the prior swing upwards.

- there was a fairly orderly pullback that left a pattern line for price to gain momentum from on the breakout.

- there was good buildup with several inside bars providing a good coiled spring from which price could launch a breakout.

However the trade was a breakout from just below the 20 EMA and price had not managed properly to break free of the 12450 level yet since the recent low was resting on that level.

Breakout 3

This was the worst of the four breakout setups. The signal bar was a huge brea bar. Not a good bull trade entry signal. Also price was just below the 12500 round number. I never trade into round numbers.

Breakout 4

Breakout 4 was the perfect set up and a lovely trade. The bears gave up when this trade set up and this is the reason why price shot upwards so quickly.

Here is why the fourth breakout was the best of the day:

- Price had failed to pull back to the 12500 round number. Showing weakness on behalf of the bears.

- Price didn’t drop below the 20 EMA during the pullback.

- Price was being squeezed upwards by the 20 EMA.

- The pullback resembles a flag formation.

- There is excellent buildup with fairly small bars rejecting upwards from the EMA.

- There was a false low in the buildup that would have put bears on alert – this caused double pressure on the final breakout.

I normally look for 20 points on forex breakout trades. This breakout was worth much more than that. Price didn’t look back until it reached 12550.

The quality of the trade was reflected by the quality of the setup.

It was a trade worth waiting for!

Learn how to trade breakouts and other chart patterns on our Trading Training online course.