When the market sets up just right, with the right context and good signal we must take the trade. In this article I talk you through a pullback reversal trade that I took this morning on the EUR/USD forex pair.

I normally take my first peak of the day at the markets about 7am UK time. This is the time that the forex markets normally get going again after a quiet period at the end of the Asian trading session.

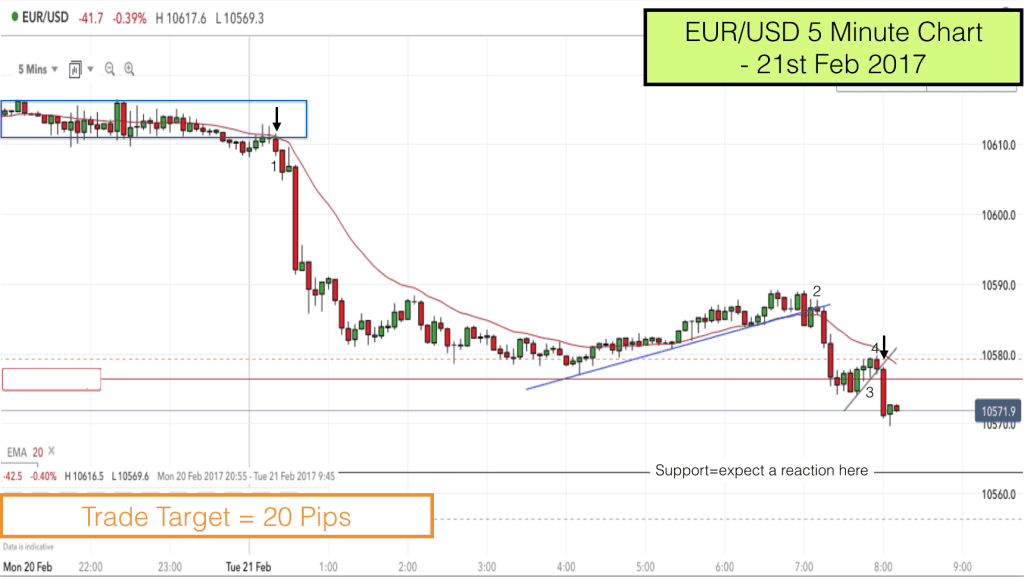

We can see from the chart that the bears had control during the Asian session and the market was in a downtrend approaching the Euro open at 7am.

Bar 1 on the chart appeared in the middle of the night and was a good signal for those awake at that time to go short for a pattern break pullback trade as the market confirmed its move out of the trading range (blue box) from yesterday.

Around 7am I was able to draw a pattern line just below the lows of the pullback from the overnight downtrend. I was looking for signs that the downtrend would continue.

Bar 2 was an inside bar at the 20 EMA and when the following bar took out its low the market was surely heading south. I didn’t take this signal to trade as it didn’t set up perfectly for me.

The signal bar 2 was just above the EMA (I like the signal bar to be below) and the bar before bar 2 was a bull bar. I would have preferred a bear bar here.

The market did indeed fall for ten pips or so and then started making its way back to the 20 EMA.

At 8am I was poised to take my trade. The pullback had almost reached the 20 EMA and the 7.55 bar (bar 4), was a small doji with a bearish body. It was nearly an inside bar (with bar 3) and it was settled just under the 20 EMA. It looked like a good signal bar to me for a trend continuation trade.

I needed the 8am bar to take out the low of bar 4 and cross the pullback pattern line for my short trade to trigger. It did this within a few seconds of opening.

8am is the London open and the market can be quite volatile at this time so I allowed a ten pip stop for my trade. However on this occasion the 8am bar was a long bear trend bar and so it was perfect for me.

My target on these forex breakout trades is 20 pips. So I had a 2:1 reward to risk on the trade. We had made a good start with the entry bar and I could only see one possible hurdle for the trade to overcome, which was a horizontal support line at 10563. This was a few points before my target.

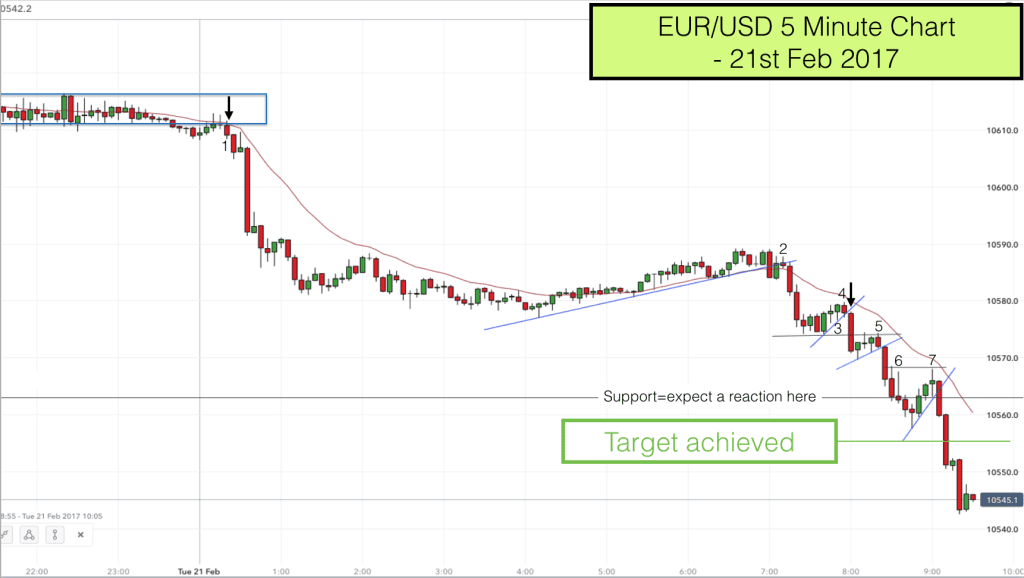

After a couple minor pullbacks the trade completed successfully.

You can see at bar 5 that the market made a ceiling test with the lows from the previous pullback before heading south once again.

The 10563 support level produced the expected reaction from the market and temporarily gave the bulls some hope of avoiding a complete collapse. However the highs of bar 6 and bar 7 produced a double top and seeing this I suspect the bulls gave up. The market came down and powered past my target to reach the 10550 round number with hardly a pause for thought.

We were done and dusted with this trade just after 9am. A good mornings work. :)

Trading doesn’t take all day and if you are interested in a lifestyle change and more free time it can be a great way to earn a living. Learn how to trade price action and chart patterns like this in our Day Trading Training course