It was generally a quiet day on the markets today due to a US holiday. There was however one good trade available first thing this morning on the EUR/GBP Forex market. It was a Pullback Reversal trade. I’ll walk you through it.

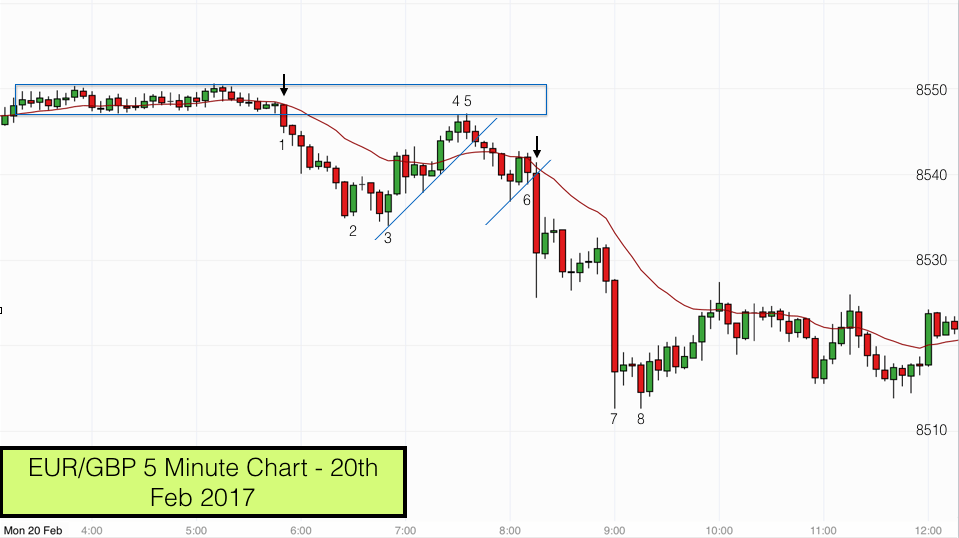

The above chart shows the price action from this morning on the EUR/GBP. You can see that the first few hours on the chart were typically quiet. This was towards the end of the Asian trading session. We are able to draw a box around the price action running up to 5.50am UK time. This box contains the tight trading range that formed in the quiet hours first thing in the European morning. This trading range was hovering just below the 8550 round number level.

Price breaks out of the tight trading range at 5.50am and may have provided a reasonable scalp for early European risers. However with the 8550 level being just above the high of the breakout bar (1) it would have been a touch and go decision to take the trade bearing in mind the magnet effect that round numbers tend to have on price.

Bars 2 and 3 on the chart are bull reversal bars that halted the bear trend temporarily. They also formed a double bottom well away from the 20 EMA (red wavy line) and so will have offered countertrend traders a possible scalp trade back to the EMA.

In fact by 7am price had made it back to the 20 EMA and by 7.30 price was actually touching the lower edge of the box extension from earlier in the morning. The lower edge of the box provided sufficient resistance to turn price around and from there the bearish trend resumed. Bars 4 and 5 both had highs touching the lower level of the box extension and they formed a mini double top. The bar following bar 5 crossed the pullback trendline (or pattern line).

Was bar 5 a good signal bar for a short trade? There were dangers in taking this trade. At this stage price was still above the EMA (which could have provided a barrier to a move downwards) and also it was quite close still to the 8550 round number magnet, so for me it was a trade to miss.

Price moved down from bar 5 to cross the EMA and paused near the previous swing lows. From here it pulled back again to the EMA. Bar six was an inside bar sitting just under the EMA and when the next bar took out its low we had a near perfect short pullback reversal trade.

You can see that our entry bar below bar 6 also took out the pattern line connecting the three lows in the pullback. It was a trade from the EMA and it was a trade with an inside bar as a signal bar. These three aspects give the trade excellent confluence. Additionally it was just after the London open at 8am.

On these forex trades I am normally looking for a 20 pip target for my trades. This one made the 20 pips comfortably before bar 7 and 8 made a double bottom and bears began to cover their shorts – signalling the end of the downtrend.

Learn with us to trade price action on our online trading courses.