Trading double bottoms for failure can be a high probability trading strategy when a market is in a downtrend. Does this mean that double bottoms are failed chart patterns? Let’s take a look at some price action in a bit of detail to reveal the truth.

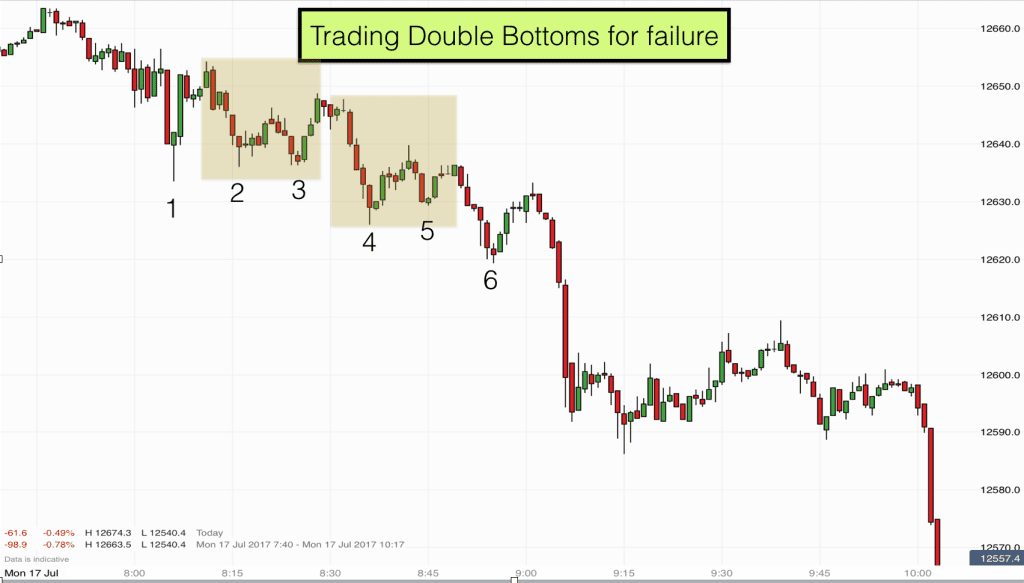

We had a number of chart patterns emerge today on the DAX 1 minute chart. I’ve picked out a couple of double bottoms to discuss as they both failed and there was a good indication that they may do this as they emerged on the chart. When double bottoms fail then we often have a good chance of a trade against them.

As you can see from the chart the DAX has been in a downtrend all morning. We can see that now with the aid of our chart, however in its early stages and as the downtrend is unravelling it is not always clear that it is going to take place.

Indices tend to spend a great deal of time in trading ranges and 80% of the time they will reverse when they reach a support or resistance level rather than develop into a trend. However when a trend does emerge it will tend to be very powerful and coast through the various support and resistance levels with only a minor pause.

Double bottoms are hugely popular chart patterns to trade on indices. When a market reaches a support level then traders look out for double bottoms to appear before they trade the reversal back to the top (or middle) of the trading range.

In this case both the double bottoms on the chart failed and the market carried on downwards.

How predictable were these double bottom failures?

The key with double bottoms is to look for a low at a support level followed by a similar and slightly higher low. The trade is to wait for the second low to be rejected and then trade the market back up.

There are several ways to trade double bottoms but the most common is to enter a long trade after the market closes above the highest point in the middle of the pattern.

It is always very important to read the price action in the candlestick bars before taking any trade. This is a skill that we teach on our Day Trading Course.

Just looking at the price action before the first low on the chart at 1, we can see that the biggest and most powerful bar was actually the bar before 1. It is massive, red and closes on its low. This is a very bearish candlestick indeed.

When we get candlesticks like this huge red one then most traders will assume that the market has further to go down. It is a big red trend bar.

Take a look at the bars in between 1 and 2 on the chart. The bar after 1 is big and green and closes on its high but it doesn’t quite retrace all of the breakout move of the big red bar preceding 1. After the big green bar we get a red bar. This is a tell-tale sign that the retrace may not have legs – there is no follow through.

The market then makes its way down to 2. On the way down there are three red bars out of four bars. This again is very bearish.

The market puts in a higher low at 2. Could this be a double bottom? No, the highest point in between the lows of 1 & 2 is almost at the same level as the previous high. There is no ground for the market to make back up.

In fact the high is just below the breakout point for the move down to 1. This is very important as it indicates that the market is confirming its downward intentions.

In order to trade a double bottom there must be a big and strong move down to the low. This provides the market with ground to make back up. This ground does not exist in this case. It was a hesitant move down by the market to the low at 1.

How about a double bottom between 2 and 3?

This is a bit more like it. There are three consecutive red bars moving down to point 2. which do provide space for the market to move back up. However just look at the bars moving up from 2. They do not show bullish strength. They are green and red. The chances are that when the market next moves back up it will again provide a similarly weak bullish retrace.

The high between 2 and 3 is about half of the way down from the previous high to point 2. This does leave some room for a trade upwards but bulls would be assuming that the best that they were going to get would be failure of the market to rise above the breakout level which matches the high between 1 and 2. Therefore there is not enough room for a good risk to reward trade on the double bottom.

When we see patterns that are likely to fail because they do look quite right, then there is often good reason to trade against it.

How to trade double bottoms for failure

In this case the trade entry was betting on failure of the 2,3 double bottom. The entry was after the tiny little gravestone doji at the high between 3 and 4. This provided a great risk to reward trade. The protective stop being above the high of the doji bar. Target was a minimum of a move down to the low of 3. In fact we got much more in this case.

The move down to 4 was a strong bearish move. Four consecutive big bear trend bars with two of them closing on their low. When the market made a double bottom at 5 there was an extremely good chance that it would fail.

Again look at the bars between 4 and 5. The most powerful bar is the red bear bar before the low at 5. It closed on its low and that is a great indication that the move down still has a way to go.

Again the pattern looked quite good with room for the market to move back up but the price action told another story. Bet on the double bottom failing!

As you can see, after 5 the market failed to reach the high between 4 and 5 and then plummeted down after making a lower low at 6. In this case a sell trade anywhere would have been effective with the protective stop above the prior high. The market was now confirming that it was in a downtrend.