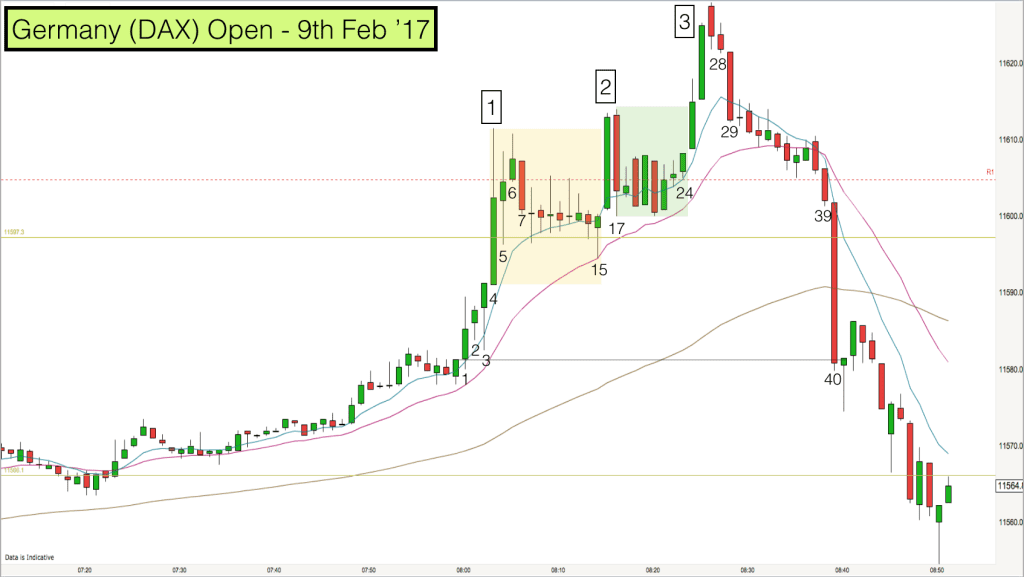

We are going to look at trading opportunities on the Germany (DAX) open today. I trade this market regularly in the early mornings. There are often several excellent trade setups within the first hour on this market and so this is a perfect opportunity to get the day underway with some quick wins.

I’m going to take you through the price action on the one minute chart above bar by bar so that you can start to understand what I am looking for in terms of trading opportunities and how I structure my trades.

Volatility is high on the open and the day often starts with a short burst in one direction and then a reversal, this is exactly what we got today with a lovely three push wedge pattern (boxed numbers, 1,2,3 on the chart) signalling the top.

Pre-market analysis

I usually get to my charts about 7.30am. This gives me half an hour before the open at 8am to do my pre-market analysis.

In this analysis I look for the likely support and resistance areas around the current prices and get a feel for the overall sentiment in the market.

On the longer timeframes the DAX is in a trading range at the top of a bull trend. We have been dropping down from the recent highs and currently we are in a bear (downward) leg in this trading range.

On the short term charts we are actually in a bull leg in a smaller trading range. Each of the 30 minute, 5 minute and 1 minute charts are above their 90 day, 20 day and 8 day moving averages. For me this means that on the open I am looking for the market to spike upwards.

Since we are in a trading range I will be looking for quick scalp trades at the open. This means taking 1:1 to 1:2 risk to reward trades with a high win probability to ensure that my traders equation is positive.

Support and Resistance Levels

On the chart you can see that I have plotted several horizontal support and resistance levels.

I have the Pivot Levels plotted on my charts and you can see the red dotted line is the R1 resistance level.

Additionally I have a couple of (green lines) longer term support and resistance levels that I have had on my charts from previous price moves. You can see that prices have moved steadily away from the lower of these green lines in the price action since 7am.

The green support and resistance level in the middle third of the chart and the R1 resistance level surround the important 11600 round number so this is an important support and resistance zone.

Trading the Germany Open

At 7.58 I focus entirely on the price action. The price has pulled back slightly and is still above the EMAs. This is perfect for a buy trade on the opening bar if I get the right signal.

I am waiting for signs on the open that indicate that the market is going higher. The 7.59 bar is a small bullish pin bar that closes above the 8 EMA.

Trade 1

Bar 1 on the chart almost immediately goes above the 7.59 bar, this triggers me into a long trade (buy trade). My stop is really tight on this trade and is below the low of the 7.59 bar. I notice that there is actually a tiny double bottom, 7.57 and 7.59 bars – this adds to my confidence in my long trade.

Bar 2 is an inside bar (it fits inside Bar 1) and it is a bullish pin bar. Perfect.

Bar 3 dips slightly below the low of Bar 2 and immediately rejects off the 8 EMA. This also closes as a bullish pin bar. Higher prices are very likely now and I am waiting for a spike upwards.

Bar 4 pops upwards. The pop is almost instantaneous and within 6 or 7 seconds price has pierced the support and resistance zone. I exit my trade above R1 as the market just started pulling back a couple of points.

The market had blasted through my 1:2 risk to reward target (which was a mental target rather than a limit order target) and I was rewarded with about 1:7 risk to reward on the trade.

Trade 2

We are now in breakout trend phase on the 1 minute timeframe. This means that higher prices are likely.

Before going into a second trade I am looking to see whether the support and resistance zone holds during the pullback from the breakout spike.

Bar 5 was an inside bar, a range bar.

Bar 6 was another inside bar (inside Bar 4) and was showing some rejection at the top. Time to wait and see.

Bar 7 continued the pullback and was a further inside bar. We then entered a very tight trading range of eight additional inside bars.

Bar 15 was a bullish pin bar and it closed above the 20 EMA, showing rejection of lower prices and possibly the end of the pullback.

Bar 16 took me into a second long trade of the day. It opened just above the 11600 level and burst up above the R1 level. Again I had a tight stop on this trade. My stop was just below the Bar 15 low.

I exited at 1:2 risk to reward, near the top of Bar 16. This was good timing as Bar 17 pulled back to close below R1 again.

By this time I was aware that we had two tops (1,2 boxed on the chart). I am always on the lookout for three push patterns (wedges) as they can act as flags for reversals.

Again we had a number of inside bars (inside Bar 17 – green box on the chart) as price consolidated the pullback. These inside bars were holding above the 11600 level, which is a good sign for further upward prices.

Trade 3

Bar 24 showed slight rejection at the bottom and then closed on its high and above the 8 EMA. This again was a great signal bar. You can see at this stage how price was bending the 8 EMA higher ( a good sign of a breakout). It almost looks like the 8 EMA is compressing price upwards, this is a good thing to look out for as it tells us that other traders are seeing value in buying above the 8 EMA.

Bar 25 triggers a third long trade. Again my stop is below the low of Bar 24 – the signal bar. Price doesn’t look back and I exit my trade as the market makes a new high. Another 1:2 risk to reward trade.

Tight stops on these trades work really well as we are looking for an immediate burst of price action in our favour, if we don’t get it then it means that the context for our trade is wrong and in that case we need to exit the trade.

This was the third scalp trade of the day and the third push. Bar 27 gapped higher and then pulled back immediately.

Bar 28 was a bearish pin bar, countertrend trades will have gone short at the close of that bar.

Bar 29 was a bearish trend bar, closing on its low and this indicated that we should start to expect a reversal.

Price crossed over the 8 EMA and the 20 EMA. Bar 39 took the market below the 11600 level and it closed near its low. This was a good signal bar for a likely bear breakout. I didn’t take the trade as I was too slow on this occasion but Bar 40 crashed downwards and closed at the open price of the day – black horizontal line.

What a start to the day! Four excellent scalp trade opportunities, good risk and reward trades and all within the first 40 minutes of trading.

As always I hope that you found this analysis interesting and useful. Trading on the 1 minute timeframe is very quick and requires a good trading system that you can trust with your trades. If you want to learn to trade and make a living from trading then our day trading courses are a gateway to your future, I think that you will love it.